There are many predictions for the price of silver and gold. Some say silver will crash to nearly $20 and gold back under $1,200, and others proclaim silver $100 and gold at $2,500 by the end of 2012. The problem is that some predictions are only wishful thinking, others are obvious disinformation designed to scare investors away from silver and gold, and many are not grounded in hard data and clear analysis. Other analysis is excellent, but both the process and analysis are difficult to understand. Is there an objective and rational method to project a future silver price that will make sense to most people? Clearly Yes!

I am not predicting a future price of silver or the date that silver will trade at $100, but I am making a projection based on rational analysis that indicates a likely time period for silver to trade at $100 per ounce. Yes, $100 silver is completely plausible if you assume the following:

- The US government will continue to spend in excess of $1 Trillion per year more than it collects in revenue, as it has done for the previous four years, and as the government budget projects for many more years.

- Our financial world continues on its current path of deficit spending, debt monetization, Quantitative Easing (QE), weaker currencies, war and welfare, ballooning debts, and business as usual.

- A massive and devastating financial and economic melt-down does NOT occur in the next four to six years. If such a melt-down occurs, the price of silver could skyrocket during hyperinflation or stagnate under a deflationary depression scenario. (best candidate for hyperinflation = JAPAN)

Same is true for $2,500+ gold prices.

USA National debt projections: by 2020 it will be over 20+ TRILLION

http://en.wikipedia.org/wiki/File:CBO_-_Public_Debt_Scenarios_-_June_2011.png

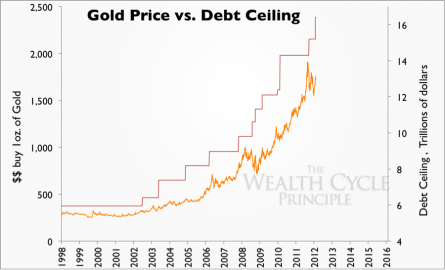

Also, With a debt to GDP ratio now at 105%, the U.S. crossed the significant 100% threshold around the beginning of the year. The deeper into debt the U.S. and other countries around the world go, the less valuable the dollar and all paper currencies become—and the higher the value for gold.

We may be skeptical of price projections for silver and gold, but projections for national debt are quite believable. Since the correlation is very close, future silver prices can be projected, assuming continuing deficit spending, QE, and other macroeconomic influences. A dollar crash or an unexpected bout of congressional fiscal responsibility could accelerate or delay the date silver trades at $100, but the projection is reasonable and sensible. Silver increased from $4.01 (November 2001) to over $48 (April 2011). A silver price of $48 seemed nearly impossible in 2001, yet it happened. An increase from about $32 (October 2012) to $100 (perhaps in 2015 – 2016) especially after Bernanke’s recent announcement of QE4-Ever.

All this makes $100+ silver and $3,500+ gold seem very possible.