Long Term Yen: Having broken out of the symmetrical triangle in November 2008, the Yen has produced a more lethargic rally than those seen in the second half of the 1970’s, 80’s and 90’s. The April correction even managed to violate the rising parabolic index. Naturally, the high Yen makes it more and more difficult for Japanese goods to remain competitive and this is invariably helping to keep a lid on the currency. From a purely technical perspective, the currency is back challenging the best levels of December ’08 and ’09 and forming a new ‘ascending triangle’. A move through the resistance would set the stage for strength into next summer. This timing is based upon the fact that the three previous rallies took 34 to 36 months from the low prior to the breakout. However currencies have a way of surprising us and we could very well peter out here at the low 80 level the chart below show this in reverse so the 120 level could very well be the end and we will start to see a multi month reversal in the yen, we are close to the top.

Please have a look at this Yen Aug 2010 to 2011

GOLD

Long term I do not believe the market has topped. For one thing let’s consider other commodity markets’ tops, whether it’s gold in 1980, crude oil in 2008: the last wave up is always the steepest as wave 5 of a commodity rally is always driven by panic due to lack of supply. There are fears in the market, but I don’t think we have seen panic at all. Panic will come after the Euro is disbanded, if Japan defaults, or the USD loses 10% in one week, but certainly not on fear of inflations with a CPI which is still going to be negative YoY by December (I do not give any credibility to CPI when it comes to measuring real inflation, but it’s the benchmark…).

Support is at hand time to start adding a bit more to the gold holdings . . .

Quote of the month: Bob Hoye

“In noting the exceptional corruption of central banking, it is always ironical to consider that in this bizarre financial world the worst thing that can happen is an “outbreak of sound money”.

China

Of the Middle Kingdom’s 1.3 billion citizens, only 60 million earn a $20,000 middle class annual income, while 440 million make $3-$6/day and 600 million take in under $3/day.

S&P

Think we are going lower . . . say 800 on the S&P ?

Is it Time?

Shorting the world’s most overvalued asset, the 30 year US Treasury bond, should be the big trade from here. What will be different with this meltdown is that it will be the first collapse in history of a bond market in a non-inflationary environment.

It is not soaring consumer prices that will execute the long bond. It will be the sheer volume of debt issuance. The Federal Reserve have to sell nearly $2.5 trillion of debt to cover a massive budget deficit and refund maturing paper, easily the largest cash call in history. Bring in a double dip recession and a second, larger stimulus package, and those numbers take off considerably.

Pile on top of that trillions more in offerings from states and municipalities that are also hemorrhaging debt issuance. By the end of 2010, total government debt from all sources will rocket to a staggering 350% of GDP. Throw in private debt requirements, like the rolling over of a trillion dollars worth of commercial real estate financing and your garden variety corporate offerings. The rush to borrow has started overseas too, with hundreds of billions of dollars more in Eurobonds floated by cash strapped sovereigns like the PIIGS. It’s clear that the bond markets of all descriptions are going to become very crowded places, driving rates irresistibly higher.

At some point, the world runs out of buyers, and the long bond yields will begin their inexorable climb from the current, ridiculously low 4.10% to 5.5%, 6%, and higher. Even Moody’s is talking about a ratings downgrade for the US debt, not that we should give that disgraced institution any credibility whatsoever.

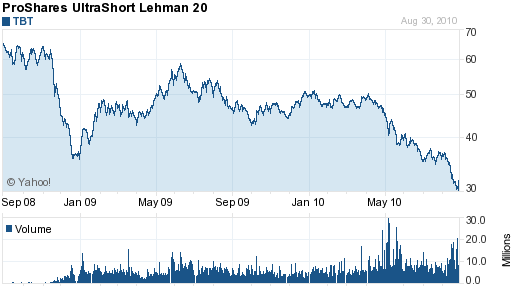

ProShares UltraShort 20+ Year Treasury or TBT is a 200% bet that long bonds are going down. It has clawed its way back up from $34.80 to $37.15 since has fallen to a low of 29.77, compared to the $70 it traded at in 2008. Falling interest rates have a silver lining in that the annual cost of carry for this leveraged ETF has dropped appreciably, from about 10% to around 8%.

If short interest rates double from the current levels, a virtual certainty, so does America’s debt service, from the current 11% to 22% of the budget. This could happen as early as 2014.

If I’m wrong on this and the 30 year yield surges under 2.5% in some sort of second Great Depression scenario, the TBT will drop down to the mid $20’s. If I’m right, the final target could be as high as $200, when long rates top 13%. That’s where they were in 1981. If you want more then take a look at the 3X short ETF (TMV) with its higher cost of carry.

Let me run some numbers here. If the yield on the 30 year Treasury bond runs up to last year’s low of 3%, the TBT will fall to a new all time low of $27. If I’m right, and we move back up to the 2010 high of 5.05%, the TBT pops back to $51.50. Running a downside risk of 11% to capture a potential gain of 68% sounds like a pretty good risk/reward ratio to me. But it might get better. Don’t forget that our long term, multi-year target for this ETF is $200.

If the futures players get this right, a move in the December long bond (ZBZ0) on the CBOT from today’s high of 134.5 to this year’s low of 111.50 multiplies your minimum margin requirement from $3,375 to $23,000, a 6.8 fold return.

But wait, there’s more! If you don’t feel like making big bets until you figure out what the new normal looks like, try a limited risk position through the TBT options. The March $30 strike calls are trading at $4. A run up by the ETF to this year’s high puts these babies at $21 at expiration, a net profit of $17, a gain of 425%.

I’ll tell you some key targets to watch for to determine the timing on this: when the yen approaches \80, the S&P 500 touches 950, the 30 year yield tickles 3%, and the ten year yield slams into 2%, it will all be over but the crying. I’m still keeping my powder dry for taking another shot at this trade, but my trigger finger is getting mighty itchy. So is it time, no not yet but it is something to watch as this will be a great trade at the correct entry point. . . which is coming soon.

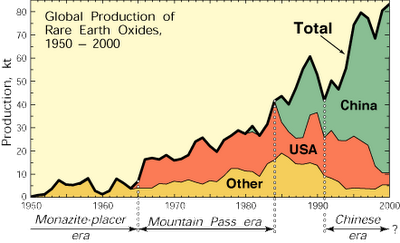

RARE EARTH METALS:

Bloomberg reports that China is cutting back 72% of its exports of Rare Earth metals. China has said that environmental issues are the reason for the cutbacks.

72% drop in availability of any commodity is important. RE’s are important. I am no expert in this but I believe that RE metals are needed in most things we make and consume. From cars to cell phones. Some more informed comments on the importance of RE would be most welcome.

Japan and the US are already protesting the ban. The rest of the world’s manufacturing base will soon follow. This could become an interesting row.

And all those folks were saying that China would be the world’s economic growth engine. Humm not so sure.

Call to find out how these can all be added to your portfolio 03 5724 5100