When everyone from Jim Cramer to Mr. T is hawking gold – and when the price has risen to all-time highs – it sure feels like a bubble.

On the other hand, the super rich – who presumably know a thing or two about investing – are buying gold by the ton.

Lewis wrote in September: Gold prices would need to surpass USD 1,455/oz to be considered extreme in real terms and hit USD 2,000/oz to represent a bubble.

Bloomberg notes: Myles Zyblock, chief institutional strategist at RBC Capital Markets, said last month gold may soar to $3,800 within three years as it follows the pattern of previous “investment manias.”

Barron’s points out: Louise Yamada, the eminent technical analyst who for many years worked at the various firms that have coalesced into Citigroup and now presides over LY Advisors, last week remarked in a client note that gold—based on its current trajectory—most likely wouldn’t represent a true bubble unless and until it gets to $5,200 an ounce (from its $1,317.80 December-contract close on Friday) within a couple of years.

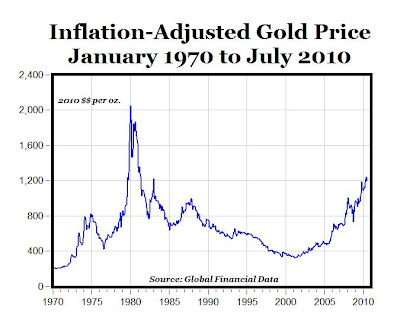

University of Michigan economics professor Mark J. Perry noted in July that inflation-adjusted gold prices are lower now than in 1980:

Adjusted for inflation, the price of gold today is 41.5% below the January 1980 peak of more than $2,000 per ounce (in 2010 dollars).

Frank Holmes, the CEO of US Global Investors said recently: “If you take a look at previous cycles, super cycles, we’re far from it,” he said. “If gold were to go to 1980 prices like most commodities have gone to, gold would be over $2 300/oz,” Holmes commented.

WJB Capital Group’s John Roque pointed out in May that the current gold bubble is still much smaller than the bubble in the 1970s when priced against the S&P.

MSN’s Money Central noted last month: Brett Arends, a columnist for The Wall Street Journal and MarketWatch, estimated that “individuals bought $5.4 billion worth of gold, and sold about $2.7 billion, (so) their total net investment comes to $2.7 billion” in 2010, through early summer.

Arends contrasted that with the $155 billion they shoveled into bond funds through July. That may be the real bubble. Arends also concluded that “if it continues along the same trajectory (of past bull markets) — a big if — gold today is only where the Nasdaq was in 1998 and housing in 2003.”

In May, Arends wrote in the Wall Street Journal: Before we assume the gold bubble has hit its peak, let’s see how it compares with the last two bubbles—the tech mania of the 1990s and the housing bubble that peaked in 2005-06.

The chart is below, and it’s both an eye-opener and a spine-tingler.

It compares the rise in gold today with the rise of the Nasdaq in the 1990s and the Dow Jones index of home-building stocks in the 10 years leading up to 2005-06.

They look uncannily similar to me.

So far gold has followed the same path as the previous two bubbles. And if it continues along the same trajectory—a big if—gold today is only where the Nasdaq was in 1998 and housing in 2003.

In other words, just before those markets went into orbit.

![[ROI_100524]](http://sg.wsj.net/public/resources/images/OB-IP413_ROI_10_NS_20100524192106.gif)