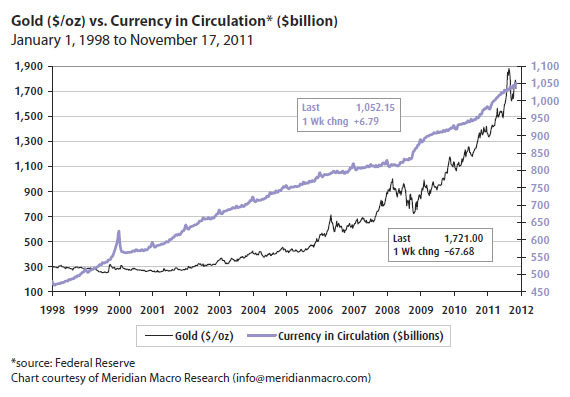

Incidentally for anyone still clamoring about a bubble in gold, the following often recycled chart by Don Coxe should put things into perspective.

The Yen, your pension, and Japan’s future: are you ready?

On March 16th 2011, five days after the Tohoku earthquake, the Yen against the US dollar went overnight from 80.83 to 76.25. In Yen quotation, ‘down’ is up: the Yen had strengthened, by 5.66%. A rather odd move, you’d think, for a country that had just suffered major earthquake, catastrophic tsunami, nuclear disaster, and the shutdown of industry along its eastern seaboard.

The Yen became a strong currency as Japan recovered form war, and its economy rose powerfully on its export-backed earnings. The consequent rise of the Yen was a multi-decade move. Well-documented, comprehensible, well-deserved even.

In the financial meltdown of 2008, the Yen acquired the reputation of being a strong currency in a crisis. The notion of the Yen strength for reasons apart from Japan’s historical export performance is puzzling when you consider Japan has the world’s worst ageing demographics, and the highest national debt to GDP ratio: 220%, and rising. Estimated at 250% by 2016, and no those bickering, rudderless politicians are not going to do anything to control their national debt’s inexorable increase.

The fundamental reason for Yen appreciation 2008-on was the unwinding of the carry trade. The Yen that the Bank of Japan had printed and thrown at the economy were not used in Japan for productive investment—Japan’s current problems go back to overcapacity at the end of the eighties and the inability to employ further capital. With interest rates on Yen at almost zero and pre-2008 on US, Australian, any kind of dollars you care to name, exceeding 5%, it was a lucrative ploy for banks and hedge funds to borrow Yen and switch them into a higher-yielding foreign currency. But when foreign-currency interest rates dipped towards zero in the maelstrom of 2008, these foreign currency positions were closed out and the money returned to the lenders, i.e. switched back into Yen.

With this vast repatriation of surplus capital, hey presto rising Yen (again)—but this time not as a result of export performance. Japan’s balance of trade is tipping to neutral, courtesy of the economic disruption of the quake, and the rise of China as a manufacturer. Yen strength post 2008 is based on a historical misconception. A Yen this strong is a symptom of a world economy out of whack.

Meanwhile the elephant in the room: that 220%-and-rising government debt to GDP ratio. In the international tables, guess who’s next. Greece, at 143%. And then Italy at 119%. Figures that have been putting them in the news recently. And seeing their borrowing costs at least double within a very short space of time, pushing debt management past the point of no return.

The interest rate Japan has to pay on its national 10-year government bond bobbles in the 1% to 2% range. Which is roughly what it has been since the mid-90s and the inception of the zero interest rate policy. The trouble is that at the size of 220% of GDP, close on 40% of annual budget goes to servicing the interest rate on the debt. If the interest rate on 10-year Japanese Government moved back above 4%, it would require the entire national tax take to service it. Back in 1993, the 10-year government bond rate was 4% (in 1989, it exceeded 8%), but in 1993, the national debt being serviced was an affordable 50% of GDP.

So perhaps you can see an endgame developing? When Japan is no longer able to sell more government bonds domestically to fund its ballooning budget it will have to go to the international capital markets to make up the shortfall—and the international capital markets won’t be quite so accommodating about 1%-2% repayments on a debt of elephantine size. 3%? 4%? These things tend to move very quickly once they start happening, as we have been seeing with Southern Europe (e.g. Italy 6-month rates went from 3.535% at the October 2011 auction to 6.504% in the November 2011 auction). If—which is a when—Japan is forced to pay 4% on its debt repayments, there won’t be any money left over for the expenses of government. And all the time the demographics are making things more difficult: fewer young productive workers footing the bill for out-of-control spending and borrowing.

How will this affect you? Well, civic bankruptcies, basic infrastructure neglect, a rising and more aggressive personal tax-take, guttering national pension payouts. A swift reversal of Yen strength—the last time the Yen went through 80 to the US dollar, in 1995, it was back at 147 three years later. And probably, in the end, no matter how hard they try to fight it, hyper-inflation.

Recommendations: at ‘strong’ Yen rates available, diversify into other currencies: diversify meaning several (because who knows the fate of the Euro, of the US dollar etc.). Invest in emerging, demographically healthy economies. If you want to own hard assets here, buy high-end land, against the inflationary possibility. But make sure it is high end, as a declining population will mitigate against land value. Buy gold. And make sure you have your own personal pension plan outside Japan, offshore if you wish. It’s perfectly legal. Indeed a personal pension plan outside Japan can, in its range of holdings, accomplish all these investment objectives (land excepted) in a single package.

For more information on starting a personal pension plan and lump sum investing too, please get in touch on 03-5724-5100 or info@bannerjapan.com

A BBC hardtalk program

Anyone needing a quick summary of the main tension lines in Europe as they currently stand can probably not do any better than the attached explanation by Kyle Bass.

The video below explains more than a full day of watching the financial funny channel from basic cable. In a nutshell: Europe is about to see trillions in debt written down (the only mathematical explanation which makes sense), the “profligate idiot” spenders of Southern Europe are not going to be bailed out by Germany, which has decided it has had enough of the “Mexican standoff” within the Eurozone, and will not be held by the short hairs any longer. And as for the quote that captures the total and utter chaos in Europe: “they have a German pope and an Italian central banker.”

Get in touch and we will assist you place your assets correctly. 03 5724-5100

It’s Official: Total US Debt Passes $15 Trillion

The total US debt has increased by 41.5%, or $4.4 trillion, from $10,626,877,048,913 on January 20, to $15,033,607,255,920, under Obama as president. Ohh and it is still growing !

http://www.usdebtclock.org/ (as a reminder the most recently updated debt ceiling is $15.194 trillion)

Bullish Sign For Gold: Falling Inflation

Whilst many may argue that gold is an inflation hedge and therefore inflation is bullish for gold, in reality the dynamics at play here are not that simple.

In our view, a drop in inflation would be a very bullish signal for gold prices.

In our view, gold is a currency. Therefore fluctuations in its price are largely based on its perceived value relative to other currencies. We would not suggest that its role as an inflation hedge is a primary reason for being long gold, since there are far more direct and efficient ways to hedge against inflation risk in this modern financial environment. We do however see currency devaluation as a primary reason to own gold. If one thought the Yen was going to strengthen against the dollar, then one would move USD holdings into JPY. If one thought the Yen was going to weaken against sterling, then one move JPY holdings into GBP. This environment is unique as across the world governments and central banks are trying to lower the value of their currencies. Therefore there is nowhere to go, except for gold which cannot be printed in an attempt to erode its value.

To view this article in its entirety just click here.

Nov. 2011 Finance in Focus; Gold Thoughts

According to data from the IMF, central banks continue to be significant net buyers of

gold. Mexico has added most to its reserves, with a net 83.7T of gold between

January and September 2011, followed by Russia, which has added 59.3T this

year, and Thailand, which has added 52.9T (see chart).

Central Bank Purchases of Gold So Far in 2011

Many market participants and non gold and silver experts tend to focus on the daily

fluctuations and “noise” of the market and not see the “big picture” major

change in the fundamental supply and demand situation in the bullion markets –

particularly due to investment and central bank demand from China, India and

the rest of an increasingly wealthy Asia.

The central banks of India and China are rightly believed to be again quietly

accumulating gold and the IMF figures do not include this potentially very important

and significant source of demand.

China’s gold reserves are very small when compared to those of the U.S. and indebted

European nations. They are miniscule when compared with China’s massive foreign

exchange reserves of over $3 trillion.

The People’s Bank of China is almost certainly continuing to quietly accumulate

gold bullion reserves. As was the case previously, they will not announce their

gold bullion purchases to the market in order to ensure they accumulate

sizeable reserves at more competitive prices. They also do not wish to create a

run on the dollar – thereby devaluing their sizeable reserves.

The deepening Eurozone debt crisis and real possibility means that central bank

demand will remain robust and may even increase in the coming months.

Central bank demand has put a floor under the gold market and will likely help propel

prices above the nominal record high in the coming weeks.

Comparing the gold market of today to the gold market of 1980 is ridiculous. Talk of the

gold bubble bursting remains extremely ill informed.