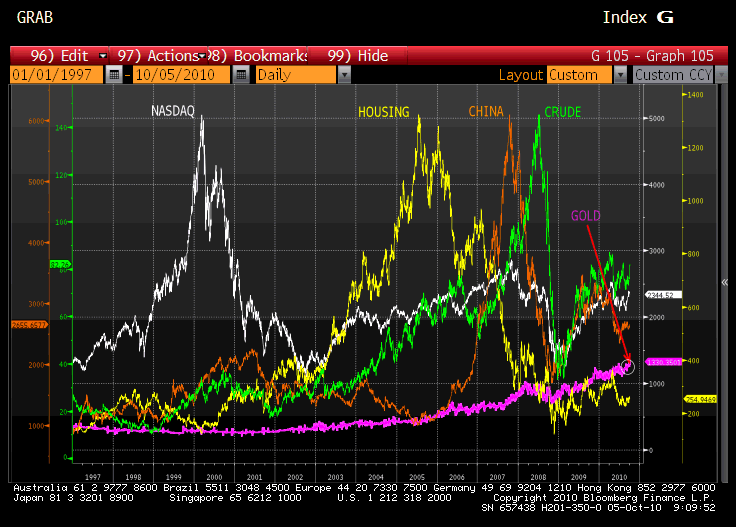

The current situation reminds me of mid 2007. Investors then were content to stick their heads into very deep sand and ignore the fact that The Great Unwind had clearly begun. But in August and September 2007, even though the wheels were clearly falling off the global economy, the S&P still managed to rally 15%! The recent reaction to data suggests the market is in a similar deluded state of mind.

Greece vs. The United States: Key Ratios

Deficit as % of GDP

Debt as % of GDP

- US: 86.5% (including GSE* debt: 121.6%)

- Greece: 115.1%

* Government Sponsored Entities

Debt as % of revenue

- US: 358.1%

- Greece: 312.2%

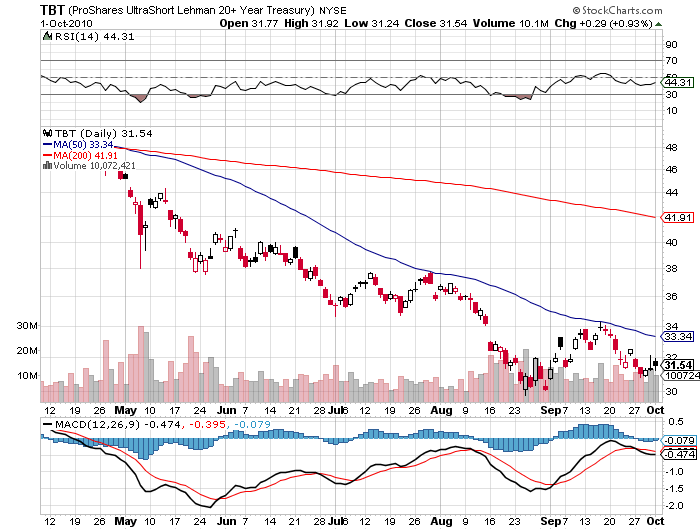

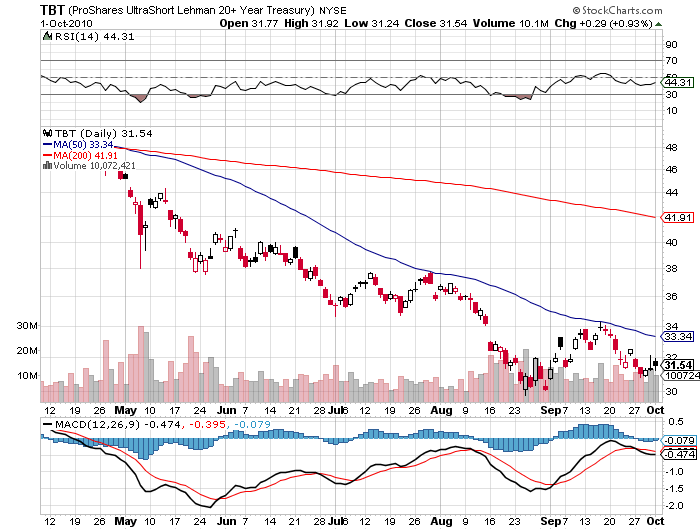

Last month we said consider ProShares UltraShort 20+ Year Trea (ETF) (Public, NYSE:TBT)

And we said to consider buying at 30 so we are still up! This will be a good longer term play.

We also said buy Gold – One fund is up 23% since launch this February!

The results again speak for themselves.

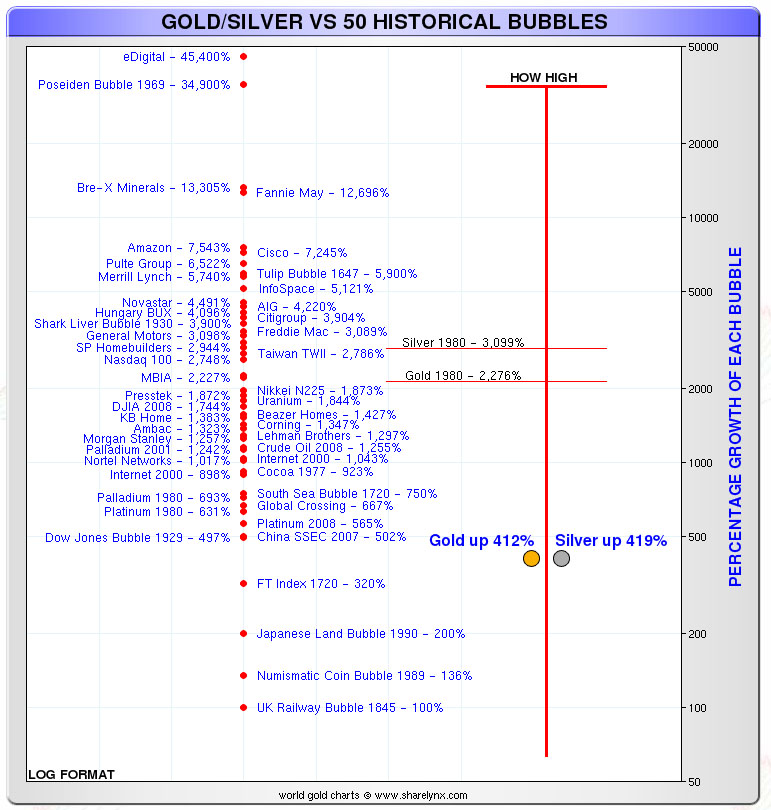

Thought ON GOLD:

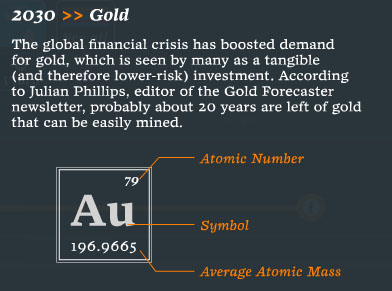

If investors were to switch only 1% of the global market capitalization of equities and bonds into gold, at the current gold price of around USD 1,250 per troy ounce, this would translate into demand of 36,000 tons. According to the US Geological Survey, this is roughly equivalent to the known gold reserves. In reality, however, there will be a mix of gold purchases and increases in gold prices. At a gold price of USD 2,500, only 18,000 tons of gold would be required to reach a share of 1%.

Gold – The price of gold has moved in correlation to the monetary base for as long as they have tracked the two data items. As the Fed prints more money, gold should rise. If the Fed were to increase the monetary base by 100% over the next 3 years, Gold should increase by that same amount. Additionally, as inflation accelerates, investors tend to push gold higher than its correlation, like in 1980 when it increased an additional 100% above the correlation. So if gold is at $1,200 now, it should hit $2,400 on the monetary expansion alone, then $4,000 as investors flee inflation.

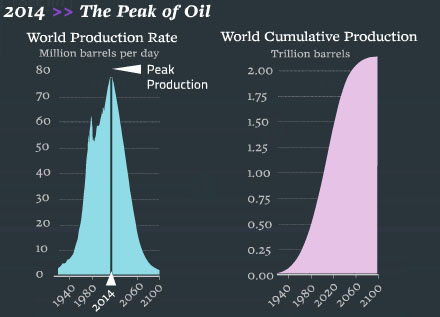

Energy Thoughts

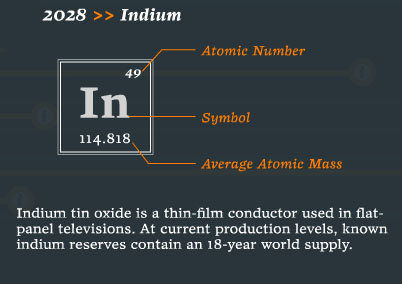

Scientific American has done a great summary of peak commodity levels as well as depletion projections for some of the most critical resources in the world including oil, gold, silver copper, not to mention renewable water, as well as estimating general food prices over the next half century. Generally speaking, regardless of whether one believes in peak oil or not, the facts are that stores of natural resources are disappearing at an increasingly alarming pace. And instead of the world’s (formerly) richest country sponsoring R&D and basic science to find alternatives, the US government continues to focus on funding a lost Keynesian cause, debasing the dollar and perpetuating a system that will do nothing to resolve any of these ever more pressing concerns. Furthermore, as by 2020, the US will have around $23 trillion in debt (per CBO estimates), the government will be far too focused on using anywhere between 50-100% of tax revenues to cover just interest expense, than funding science and research. Then again it is probably only fitting that future generations will be saddled with not just $100 trillion in total sovereign debt, but will be running out of water, will see sea levels rising ever faster, will have no flat screen TVs, and will be using Flintstone mobiles to go from point A to point B.

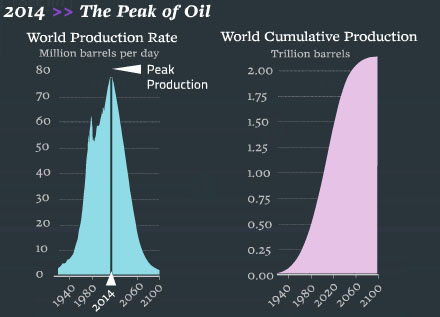

Some key highlights from Scientific American, as well as the year in which a given resource either peaks or runs out:

Oil – 2014 Peak

The most common answer to “how much oil is left” is “depends on how hard you want to look.” As easy-to-reach fields run dry, new technologies allow oil companies to tap harder-to-reach places (such as 5,500 meters under the Gulf of Mexico). Traditional statistical models of oil supply do not account for these advances, but a new approach to production forecasting explicitly incorporates multiple waves of technological improvement. Though still controversial, this multi-cyclic approach predicts that global oil production is set to peak in four years and that by the 2050s we will have pulled all but 10% of the world’s oil from the ground.

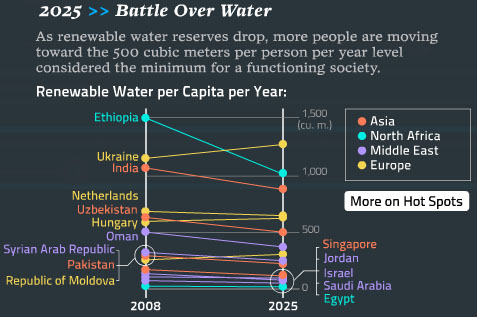

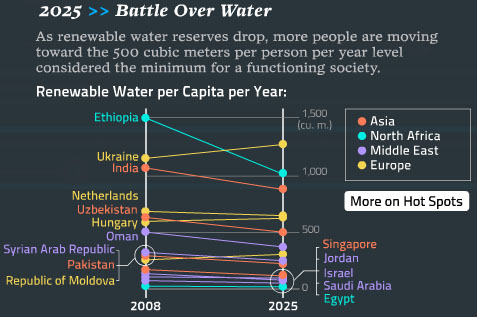

In many parts of the world, one major river supplies water to multiple countries. Climate change, pollution and population growth are putting a significant strain on supplies. In some areas renewable water reserves are in danger of dropping below the 500 cubic meters per person per year considered a minimum for a functioning society.

Renewable Water

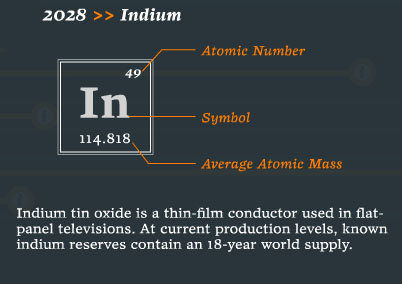

Indium – 2028

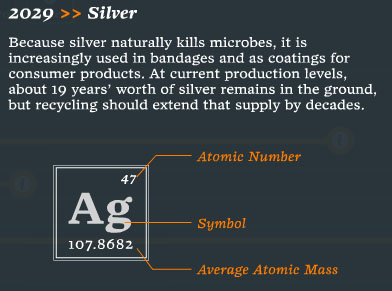

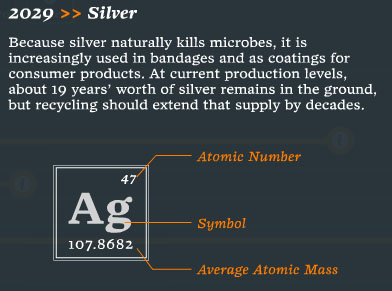

Silver – 2029

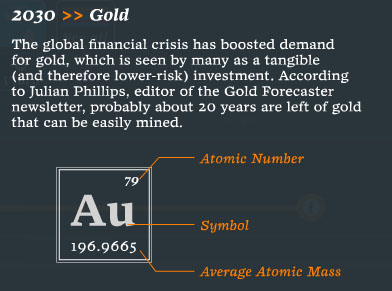

Gold – 2030

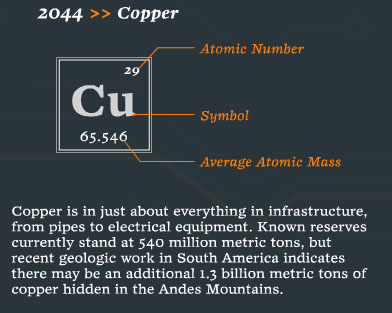

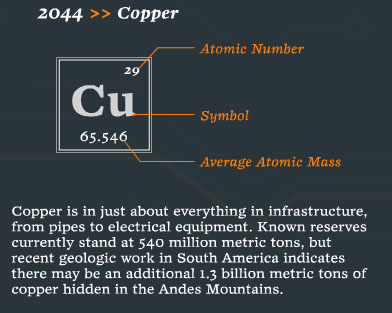

Copper – 2044

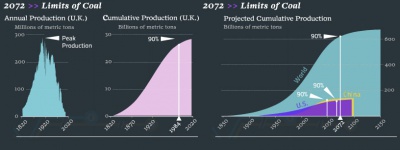

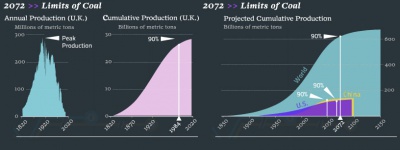

Coal – 2072

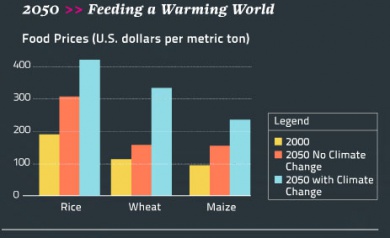

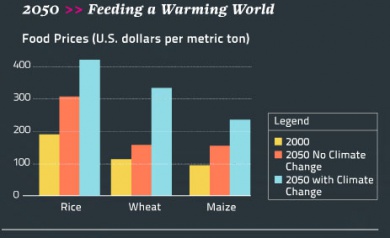

Food Prices over next 40 years

Researchers have recently started to untangle the complex ways rising temperatures will affect global agriculture. The expect climate change to lead to longer growing seasons in some countries; in others the heat will increase the frequency of extreme weather events or the prevalence of pests. In the US, productivity is expected to rise in Plains states, but fall further in the already struggling Southwest. Russia and China will gain, India and Mexico will lose. In general, developing nations will take the biggest hits. By 2050 counteracting the ill effects of climate change on nutrition will cost more than $7 billion a year.

YEN

Investors see yen as “safe” due to the fact that Japan has a current account surplus and its government debt is mostly domestic instead of foreign. Moreover, prospect of a slowing growth in the U.S. and talk of the Fed’s continuing quantitative easing–driving interest rates even lower–further discourage dollar holding.

Generally, a country’s currency value rises with a healthy GDP growth, but in the case of Japan, it is quite the opposite. Despite Japan’s ongoing current account surplus, a currency out of line with fundamentals could pose risks to its stability.

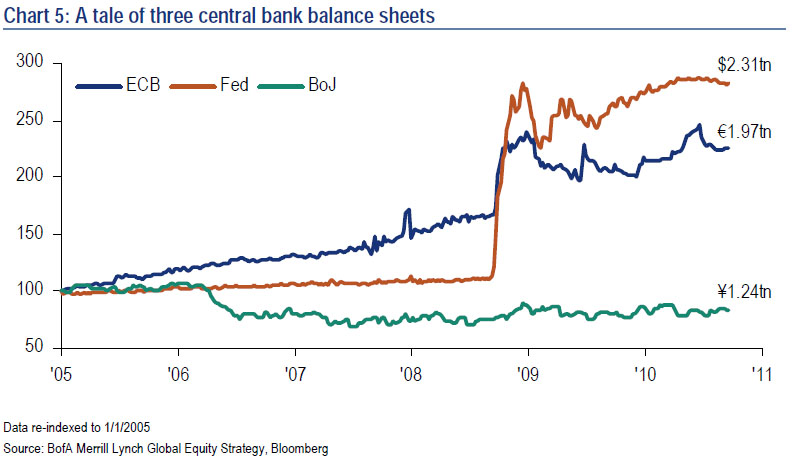

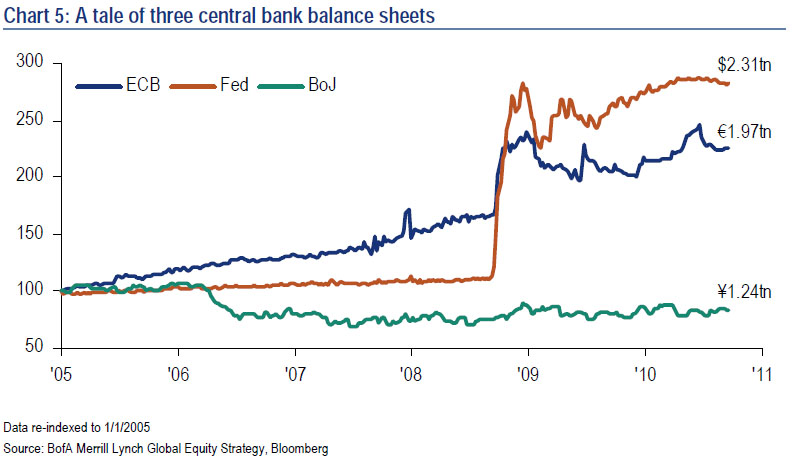

As a reminder, here is how Japan has demonstrated remarkable restraint (at least recently) as everyone else has been printing.

So will the BOJ start QE to catch up to the rest or will Japan sit here and take it on the chin?

Did You Know: Currently, a stunning number of Americans, 52 million, are receiving life-sustaining assistance from government “anti-poverty” programs, such as food stamps, unemployment benefits, Medicaid and Medicare. This has already stretched a social safety net system that is designed to handle significantly less people to its limit. This safety net system has now been drained of all reserve resources over the past two years, and is obviously not sustainable under current economic and political conditions.

As social safety net programs have been drained of reserves, many US citizens have also been burning through their personal savings. Over the past few years the percentage of Americans living paycheck to paycheck has dramatically increased. In 2007, 43 percent of Americans were living paycheck to paycheck. In 2008, the percentage increased to 49 percent. In 2009, the number skyrocketed up to 61 percent. The most recent number for 2010 has exploded to a shocking 77 percent. This means in the USA a nation of 310 million citizens, 239 million Americans are one setback away from economic ruin and millions more are in danger of having to rely on government assistance for survival.

Now is the Time to Do it yourself: http://www.bannerjapan.com/best-to-also-have-a-personal-portable-pension-plan-too/

Up Coming events;

The Melbourne Cup which is huge in Australia; dubbed the “Race that stops the Nation” and it is celebrating its 150th anniversary this year making the even more special. Australians all around the world will get together and organize a lunch or a get together, whether they are in Seoul, Beijing, America, England, Thailand, to name just a few places we know hold events.

The Place to be in Tokyo On race day Nov 2nd is The Grand Hyatt come and watch the Melbourne Cup LIVE — The following day is a Holiday in Japan (Culture Day). So take the 2nd of November off as an annual leave day or half day and get your friends and colleagues together; Come out and celebrate Australia!

http://www.australiasocietytokyo.com/events?eventId=210298&EventViewMode=EventDetails