Frank Holmes of US Global Investors is another who has forgotten more about the gold market

than many will ever know.

Here is his take on how far gold is off course:

Gold has been in extremely oversold territory lately despite drivers for the metal remaining in place.

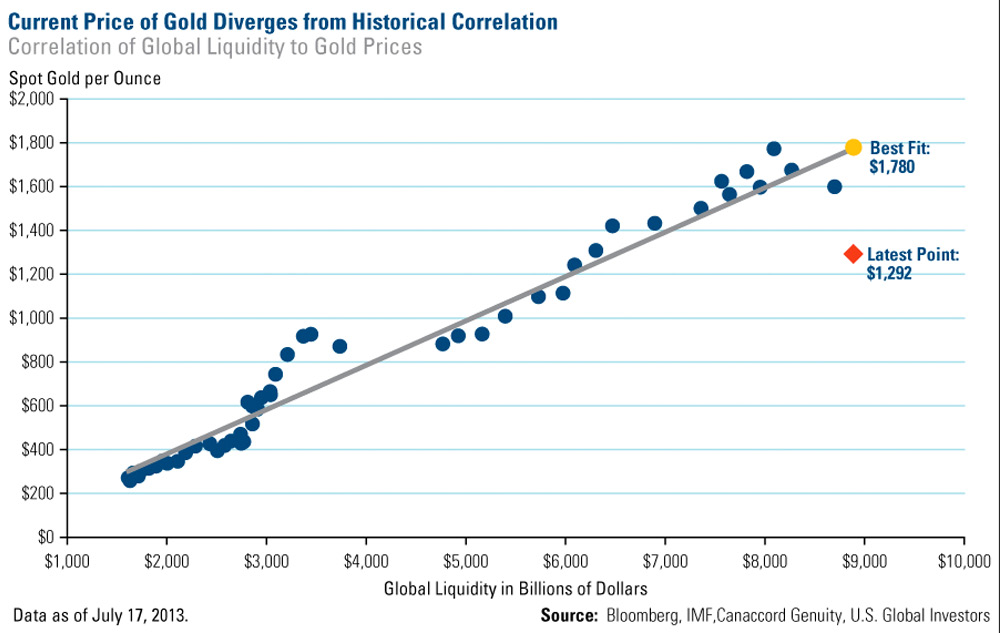

Here’s a different way to look at how far gold has been off course. The chart below tracks the correlation of the price of an ounce of gold to global liquidity, with global liquidity defined as the sum of the U.S. monetary base and the foreign holdings of U.S. Treasuries. Since June 2000, as the U.S.’s monetary base and foreign holdings increased, so did the price of gold.

The correlation suggests the current level of liquidity supports a gold price of $1,780 per ounce, well above the current spot price around $1,300.

Source: US Global Investors