A picture is worth a 1000 words – We will spare readers some of the more violent pictures we have seen of the resulting carnage as they truly are gruesome. But this is giving the markets a scare and will $100 oil cause the recession to resume? Too early to tell but by adding to energy costs, the effect of high oil prices is to reduce the amount of money for spending on other things, thereby undermining aggregate demand in the wider economy. Eventually a tipping point is reached where confidence collapses. Given what happened as recently as 2008, you would expect OPEC to be acting quickly to prevent any further explosive increase in prices.

Is worldwide inflation being casued by US Fiscal Policy?

Because the US dollar is a reserve currency (approximately 60% of global transactions are denominated in dollars) and the US is printing money to finance its trade and fiscal deficits and many countries peg their currencies to the dollar, which still remains the hub of the global monetary system, US generated inflation is being exported to the rest of the world. Reckless US monetary and fiscal policy is starting to create unrest in faraway places, as inflationary pressures intensify.

Consider the United States’ balance sheet. The United States is rapidly approaching the Congressionally mandated debt ceiling, which was most recently raised in February 2010 to $14.2 trillion dollars (including $4.6 trillion held by Social Security and other government trust funds). Every one percentage point move in the weighted‐average cost of capital will end up costing $142 billion annually in interest alone. Assuming anything but an inverted curve, a move back to 5% short rates will increase annual US interest expense by almost $700 billion annually against current US government revenues of $2.228 trillion (CBO FY 2011 forecast). Even if US government revenues were to reach their prior peak of $2.568 trillion (FY 2007), the impact of a rise in interest rates is still staggering.

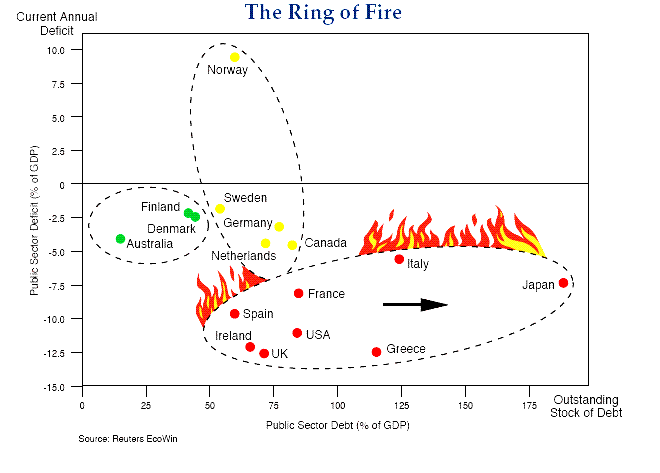

Now think about the rest of the ring of fire.

Japan the “big one” to go next?

Moody’s Investors Service has Feb 21st changed the outlook on the Government of Japan’s Aa2 rating to negative from stable.

The rating action was prompted by heightened concern that economic and fiscal policies may not prove strong enough to achieve the government’s deficit reduction target and contain the inexorable rise in debt, which already is well above levels in other advanced economies. Although a JGB funding crisis is unlikely in the near- to medium-term, pressures could build up over the longer term which should be taken into account in the rating, even at this high end of the scale.

More specifically, factors driving the decision are:

1. The severity and persistence of the shock that the global financial crisis imparted on Japan’s government finances and on aggravating pre-existing deflationary pressures,

2. As a result, the current policy framework will not be capable of overcoming hurdles blocking a return to a path of fiscal deficit reduction,

3. Increasing uncertainty over the ability of the ruling and opposition parties to fashion an effective policy reform response to the debt and growth challenges, and

4. Vulnerability inherent in the long-time horizon of Japan’s gradual fiscal consolidation strategy to worsening domestic demographic pressures, as well as to possible, renewed shocks in a fragile and uncertain, post-crisis global economic environment.

We maintain our positioning stance of long Gold, precious metals, TBT, Uranium and other Energy.

And now a bit of fun coming up;

Ireland Fund of Japan’s annual ball

Saturday, 19th March 2011 at The Westin Hotel, Ebisu, Tokyo from 6:30 PM Till Late

JPY 25,000

Now in its nineteenth year, The Emerald Ball guarantees a wonderful evening of excellent food & drink, great company, superior entertainment, and of course, the Irish “craic”. All of this comes with the satisfaction of supporting our worthy causes.

The funds raised on the night are used to promote arts, education, cultural awareness and community development programs. The Ireland Fund of Japan supports The Japan Helpline, a student exchange program, St. Patrick’s parades in Japan and homeless reestablishment assistance.

Visit them at www.emeraldballtokyo.com Go raibh mile maith agaibh!