US Federal debt

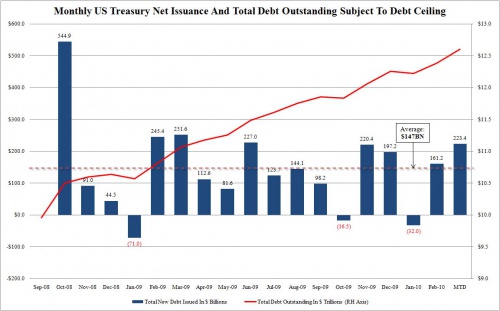

The US is on collision course with an unmitigated funding disaster. As the chart below demonstrates, the US has been issuing roughly $147 billion a month for the past 17 months, in a period in which total US Federal debt has increased from $10 trillion to $12.6 trillion. With recently passed healthcare reform, look for the red line indicating total debt to go increasingly exponential.

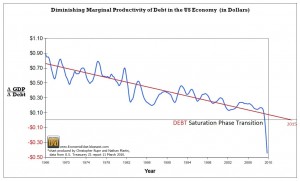

THE Most Important Chart of the CENTURY

The latest U.S. Treasury Z1 Flow of Funds report was released on March 11, 2010, bringing the data current through the end of 2009. What follows is the most important chart of your lifetime. It relegates almost all modern economists and economic theory to the dustbin of history. Any economic theory, formula, or relationship that does not consider this non-linear relationship of DEBT and phase transition is destined to fail.

It explains the “jobless” recoveries of the past and how each recent economic cycle produces higher money figures, yet lower employment. It explains why we are seeing debt driven events that circle the globe. It explains the psychological uneasiness that underpins this point in history, the elephant in the room that nobody sees or can describe.

This is a very simple chart. It takes the change in GDP and divides it by the change in Debt. What it shows is how much productivity is gained by infusing $1 of debt into our debt backed money system. Back in the early 1960s a dollar of new debt added almost a dollar to the nation’s output of goods and services. As more debt enters the system the productivity gained by new debt diminishes. This produced a path that was following a diminishing line targeting ZERO in the year 2015. This meant that we could expect that each new dollar of debt added in the year 2015 would add NOTHING to our productivity.

98 Yen to the US$ by year end?

Yen Gains Deceptive, Traders Most Bearish in 3 Years

March 23 (Bloomberg) — Japanese households are sending funds overseas at the fastest pace since 2007 in search of higher yields as currency strategists predict the yen will slump 8 percent versus the dollar by the end of the year.

Households are buying Chinese stocks and record amounts of Brazilian bonds as they reinvest the biggest sum of maturing Japan Post Bank Co. deposits in nine years. That will help push the yen down to 98 per dollar by Dec. 31 after it gained this year against all but eight of 155 currencies tracked by Bloomberg, the median of 39 strategists’ forecasts shows. Full article

Central Bank Gold Holdings Expand at Fastest Pace Since 1964

Central Bank Gold Holdings Expand at Fastest Pace Since 1964

March 18 (Bloomberg) — Central banks added the most gold to their reserves since 1964 last year amid the longest rally in bullion prices in at least nine decades, data compiled by the World Gold Council show.

Combined holdings rose 425.4 metric tons to 30,116.9 tons, an increase worth $13.3 billion at last year’s average price, according to the data. India, Russia and China said last year they added to reserves. The expansion was the first since 1988, the data from the London-based council show.

Central banks, holding about 18 percent of all gold ever mined, are expanding their holdings for the first time in a generation as investors in exchange-traded funds amass bullion as an alternative to currencies. Holdings in the SPDR Gold Trust, the biggest ETF backed by the metal, are at 1,115.5 tons, more than the holdings of Switzerland.

UK Expats lose pensions claim in EU court

The European Court of Human Rights has ruled that the UK does not need to boost the state pensions of more than 500,000 UK retirees living abroad, the way it does the pensions of those living in Britain and in certain other foreign countries.

The European Court of Human Rights has ruled that the UK does not need to boost the state pensions of more than 500,000 UK retirees living abroad, the way it does the pensions of those living in Britain and in certain other foreign countries.

In its decision, the court said the UK authorities’ refusal to index-link pensions of some former British residents was “not discriminatory”.

The long-awaited judgment will be a blow for many UK pensioners, who have long argued that they are unfairly treated by a pension system that they paid into, in good faith, when they were still working back in the UK. For them, the European Court of Human Rights in Strasbourg was their last hope.

The ruling will be welcomed by the UK Treasury, however, which could have had to pay out at least an extra £500m per year if the decision had gone against it.

Some of these expat pensioners living in those other countries where the UK “freezes” pensions at the rate at which the individual first starts to take them currently receive pensions that are half what they would be if they lived in the UK. A few, who retired back in the early 1970s, are said to receive as little as £6 a week, even though the current basic state pension in the UK is £95.25 a week.

The decision is available on the European Court of Human Rights (ECHR) website, where it is referred to as the Case of Carson and Others v. the United Kingdom.

‘Part of complex benefits system’

In the 11 to 6 judgment, the Strasbourg judges said they “did not consider that it sufficed” for the 13 British nationals who had brought the case to be “in a relevantly similar position to all other pensioners, regardless of their country of residence” merely because they paid National Insurance contributions while working in the UK.

Such contributions form part of the revenue which pays for a whole range of social security benefits, the court observed, as part of a “complex and interlocking system of the benefits and taxation systems” which “made it impossible to isolate the payment of National Insurance contributions as sufficient ground for equating the position of pensioners who received up-rating and those, like the applicants, who did not”.

“Moreover, the pension system was primarily designed to serve the needs of and ensure certain minimum standards for those resident in the United Kingdom”, the court said.

Reciprocal agreements

As International Adviser reported on Sunday, the issue was whether expatriates living in such countries as Australia, South Africa, Hong Kong and Canada – who receive UK pensions after having paid National Insurance contributions when they were still living in Britain – should receive the same inflation-linked increases, even though the countries in which they live do not have reciprocal agreements with the UK.

Britain has such arrangements with its 26 fellow EU countries as well as with the US, Iceland, Liechtenstein, Norway, Switzerland and Turkey. Officials with the UK’s Department for Work and Pensions have argued that it is not unfair to discriminate in favour of pensioners living in these countries with which the UK has reciprocal agreements, because the governments of these countries have agreed to boost the pensions of their nationals who have retired to the UK.

Seven of the 12 most popular overseas retirement destinations among British retirees are on .the UK’s frozen-pension list, an Alliance & Leicester International study found last year. They are New Zealand, South Africa, Dubai, Canada, Australia, Singapore and Hong Kong.

Pensioners in such countries have argued for years that it was unfair for them to receive less than others who paid the same amount into the pension system.

A website that identifies itself as representing the interests of British expats whose pensions are frozen, www.Pension-Parity-UK.com, estimates that approximately half of the 1.1m UK expatriate pensioners worldwide have their pensions frozen.

The case went to the European Court of Human Rights (ECHR) in 2009, but dates back years and has its origins in a suit brought by Annette Carson, a British national who lives in South Africa. Carson’s claim got as far as the House of Lords before it was dismissed on appeal in May 2005.

Later that year, she and 12 other expat pensioners moved on to the ECHR, where last year their application was referred to the final appellate stage, the Grand Chamber, after a lower ECHR court rejected it in November 2008 by 6 to 1.

UK pension ‘£95.25’

Although the basic UK state pension for 2009-10 for a single person is £95.25 a week, according to Skandia International’s head of tax and product law Rachel Griffin, Carson currently receives only £67.50 weekly in basic state pension, which she began to take in 2000.

Carson also receives £32.17 in SERPS (the State Earnings Related Pension Scheme) benefits and £3.95 graduated pension.

‘UK benefits when expats go abroad’

The Pension-Parity.UK website, meanwhile, argues that the UK benefits financially in having pensioners move abroad and stay abroad for the remainder of their lives, and notes that concerns about having to make do with a frozen pension actually causes many to stay in Britain.

“The UK Government’s own figures reveal that “every individual resident in the UK over the age of 60 costs the UK taxpayer £7,000 per [year] in terms of added benefits and a share of National Health Service costs, [which is] seven times…the estimated [added] cost per capita” of index-linking those frozen expat pensions,” the site notes.

A complete list of countries where expat UK retirees’ pensions are frozen is at the Pension-Parity website at: http://www.pension-parity-uk.com/pension-rights.htm#Are YOU frozen or are you not .

From International advisor; 16 March 2010 by Helen Burggraf

DIY is needed more than ever.

Are you counting on Social Security and a Government Pension?

Portable pension plans are a means for people working abroad to build up a lump sum for their retirement when their employment circumstances will not automatically provide them with a pension. This article looks at who such plans are suitable for and how they work. The following month’s linked article will look at the issue of rogue advisers and the questions you should ask when considering taking out a portable pension plan.Portable pension plans are pension plans for expatriates, i.e. people working abroad. They are suitable for:

They may not be suitable for:

They are particular suitable for people in their late twenties and early/mid thirties who have a career path in front of them but have not yet made any significant investments and do not want to spend much time on looking after and managing their investments. They work like this: This sum is best paid off using a credit card – this is convenient, is cheaper than using a bank to make transfers, and after a few months you don’t really notice the money going out. Your monthly contribution is then invested into a series of mutual funds. Doing things this way gives you four advantages:

As mentioned, these plans are portable. You can take them to where you live next, even if that is the country of your own nationality (there will be some restrictions for residence in the USA). As they are written technically as life insurance contracts the investments are held by an insurance company with whom you have a contract for the value of those investments. There are no dividends or distributions. The whole value sits in your plan. There are no taxes to diminish the power of compounding and therefore the full value of the plan until you take the benefits at the end of the plan. And don’t forget – all the money you put in is your money. Portable pensions plans – a means for people working abroad to build up a lump sum for their retirement when their employment circumstances will not automatically provide them with a pension. Such plans may form the backbone of an individual’s forward planning, as they confer a number of benefits:

However at the same time some members of the expatriate community have suffered problems with such plans. This article looks at two clumps of typical reasons for these problems. Firstly, a pension plan is a contract. If you take one out you should expect to fulfill its terms, which involve putting in a pre-agreed amount of money away on a regular basis for a pre-agreed number of years. (Remember, by the way, that this is still your money!) Such plans have flexibility, as they are designed for normal working people, who may from time to time lose their jobs, or decide on a change of career, or take further educational courses full-time – the plans can cope with periodic interruptions. But the more contributions that are missed, the less efficient a plan will be. It is highly inefficient and therefore inadvisable to take out a long-term plan and contribute only for the minimum period. You should be making as many contributions as you can, but should not be worried if life circumstances require you to cease contributions temporarily. You should also make sure that you set the amount you contribute at a level you can easily afford – allowing for realistic increases in your economic responsibilities or relocation to a lower-paying environment. Addressing your plan in this way will save you from over-extending yourself and allow you to reap its benefits. Therefore it is a good idea to beware high-pressure sales people who will assure you that the more you put into the plan the better, and that you should go for maximum plan length (irrespective of your circumstances) as ‘all you have to pay in is the first twelve or eighteen months’. Typically these people come from companies that have not been in town all that long, or have changed their name in the not too recent past. And they assuredly do not have your best interests in mind. Whereas your planning should be based on a thorough discussion of your circumstances, goals and responsibilities, not on the dictates of the salesperson. The second set of reasons why people get into trouble with these plans is unrealistic expectations about returns in the short term and the inability to cope with bad markets. In the life of a typical pension plan – say, 20 or 25 years – there will be a wide range of market conditions, unforeseeable except in their variability. Some of these years will be poor for a range of asset classes, and the value of a plan can fall in such years, especially if heavily exposed to the stock markets (where in general the greatest gains in value are to be had). A plan largely invested in stocks during the period 2000-2002 will have done very poorly. It would have rebounded steeply 2003-2004. However, inexperienced investors at the end of 2002 may have decided they were throwing good money after bad and ceased contributions for that reason (a mistake, as they were cutting themselves out of the averaging effect), or even decided to encash the plan. These plans have high penalties for early encashment, especially towards the beginning of the plan. There is nothing untoward about this as a pension plan should be there for your retirement; it is not a short-term savings vehicle and should not be seen as your source of instant cash. If you had a corporate pension in the country of your own nationality you would not in most cases be able to touch the money in it until you retired. Portable plans are more flexible, but the early encashment penalty is an advisable deterrent. Over time they make money, but they need time to make that money. The knee-jerk reaction of encashment because of (temporarily) poor performance is how people lose money big-time in these plans. Given these negatives, is it sensible to take out such a plan? The answer is overwhelmingly ‘Yes’, but keep in mind these dangers: that you may take on a plan that is longer than you expected or need and into which you are contributing too much; and that short-term poor performance may scare you into the penalties of early encashment. The morals here are caution, patience, and a modicum of education. These plans are very much worth having, provided you know what to expect, and the plan fits your life situation. Suggestions before starting such a plan:

In addition, shop around for the special offer that sometimes come with these plans for limited periods – with one currently available offer you can get as much as 7% added to all the money you put into your plan, have a look at the attached. All of us at Banner would be happy to discuss things further please get in touch. |

Buy Gold While Supplies Last, Says Fund Manager

Peak Gold? Gold production from mines is not adequate to meet demand. Production is dropping around the world. Holmes notes worldwide production ell 10% in 2008 and is especially dramatic in South Africa – the world’s largest producer.

Foreigners get nod to skip social insurance

Everybody needs health insurance, especially when they live and work abroad. However, insurance systems in foreign countries are often difficult to understand without native language proficiency and difficult to explain to foreign employees whose reference points are often the completely different schemes they are used to in their home countries. By taking on Private healthcare insurance you can save money and provide 100% worldwide coverage. We are happy to provide a competitive quote from at least 3 providers.

Here for both employees and employers, we introduce a short guide to health insurance options available to foreign workers resident in Japan.

Foreigners get nod to skip social insurance; http://www.bannerjapan.com/immigration-bureau-guideline-update/

Social Insurance (Shakai Hoken)

- Not everyone is eligible to join.

- Application is made via employer.

- Monthly premiums are salary linked and deducted directly from employee’s paycheck.

- Employers pay an equal contribution each month.

- Must also join the Employees’ Pension Insurance scheme.

- Members of this scheme pay 30% of their medical costs, covering sickness, injury and necessary dental work.

National Health Insurance (Kokumin Kenko Hoken)

- All foreign residents with a valid visa, allowing them to stay in Japan for a year or more, can join.

- The scheme is open to people who are not employed (expectant mothers, students, retirees, etc.)

- Premiums are calculated on a yearly basis (April – March) based on the insured person’s resident tax, property owned and number of dependents. Social and National Health Insurance premiums are based on salary.

- Premiums can be paid by bank transfer or at the local ward or city office.

- Primary members and their dependents pay 30% for inpatient or outpatient costs.

Private Health Insurance

- Private health insurance in Japan is open to all nationalities and their dependents, regardless of their visa status and employment contract.

- Private health insurance premiums are age-related and operate in a series of age brackets.

- Premiums are usually paid by credit card, bank check or bank transfer.

- The amount of deductible (the cost of treatment the insured individual must pay) can be tailored to the insured person’s needs.

- Plans cover in-patient and outpatient treatment as well as dental treatment.

- 100% Coverage is worldwide.

Points to Consider

- One of the advantages of using private insurance in Japan is that many English-speaking medical practitioners do not accept national health.

- The law currently states that foreigners living in Japan for more than one year must have health insurance; each city office is left to interpret this independently and while some accept private insurance as an adequate means of health insurance, others might not. Not having Japanese National insurance does not hinder ones visa http://search.japantimes.co.jp/cgi-bin/nn20100202a1.html?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+japantimes+(The+Japan+Times%3A+All+Stories)&utm_content=Google+Reader and Foreigners get nod to skip social insurance; http://www.bannerjapan.com/immigration-bureau-guideline-update/

- Private health insurance typically covers not only medical treatment in Japan but provides worldwide coverage, which is really important for frequent travelers.

- Teacher Healthcare Special Rates for teachers!

To find out more on Private health insurance with 100% cover contact us at Banner Japan for complete assistance. 03 5724 5100

Good news! FreeChoice petitioned against the Immigration Bureau guideline linking social insurance to visa renewal – and we’ve won! The fruits of our labors together have been realized. Guideline No. 8 has been officially deleted as of today, March 3, 2010. The newly revised (showing seven instead of the present eight) guidelines is now posted on the Ministry of Justice’s website.

While the Immigration Bureau will continue to require non-permanent residents to present an insurance card at the visa application window, not doing so will cause no negative effect whatsoever upon an individual’s visa renewal. (The guideline never applied to permanent residents; as previously, they are not required to present an insurance card at all.) Although Immigration will encourage enrollment in Japan’s social system by distributing brochures, individual offices and officers are “forbidden” to pressure anyone to join. In fact, the new guidelines state clearly that “enrollment in the social system will in no way be tied to visa renewal.” Additionally, the Ministry of Justice will set up a new hotline to field complaints from visa applicants who feel that they were in any way pressured or coerced to enroll.

The Japan Times, Daily Yomiuri, and other media have yet to report that the guideline ‘was’ (past tense) deleted. It would seem that Free Choice has the jump on the news – again. That’s because, due to your invaluable support, we ARE the news! The foreign community united together in standing up to the bureaucracy and our voices were heard. We at the Free Choice Foundation would once again like to express our heartfelt thanks to you for your participation in this important issue.

To download the new guidelines, please go here: http://www.moj.go.jp/NYUKAN/nyukan70.pdf

As you can see, No. 8 is gone!

If you want private health insurance that has 100% cover click here