The sinking ship of Japan

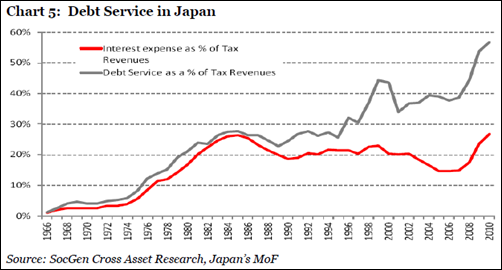

The Fed does not hold a monopoly on policy mistakes. On that account, Japan is in a league of its own, although many other countries are doing their very best to catch up. The Japanese combination of very high debt levels combined with outright deflation is a lethal cocktail, and one which the Americans are clearly desperate to avoid. I have borrowed two charts from Dylan Grice at SocGen to illustrate the enormity of Japan’s fiscal problems. Almost 60% of its tax revenues now go towards servicing its rapidly growing debt (see chart 1 below) and tax revenues no longer cover even the bare necessities – debt service, social security and education (see chart 2).

- 1. Debt Service in Japan

Source: SocGen Cross Asset Research, Japan’s MoF

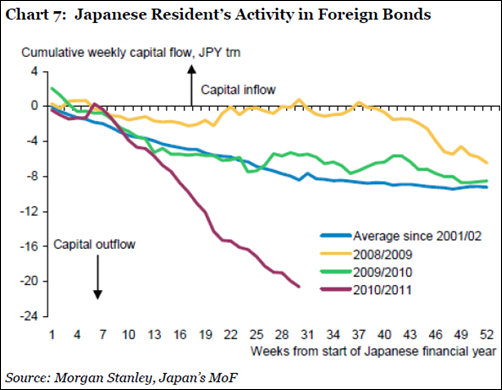

With the savings rate in free fall, and with record low bond yields, how much longer can the Japanese finance their debt domestically? Eventually, when they have to go to international capital markets to fund their out-of control deficit, will there be any buyers of 10-year JGBs at 0.95%? I very much doubt it. On that account, I have noted that the tide has already turned. As you can see from chart 3, there has been a substantial capital outflow from Japan this year.

- 2. Tax Revenues in Japan

Source: SocGen Cross Asset Research, Japan’s MoF

You may ask, if investors are fleeing Japan, why is JPY not weakening? I only know one possible explanation (courtesy of Morgan Stanley). Much of the capital which is leaving Japan is finding its way into US Treasuries, and most of those investments are fully hedged, which neutralizes the effect on the currency. In short, when you take money out of Japan to invest in the US, you sell JPY against USD; when you subsequently hedge your currency risk, you sell USD against JPY.

Chart 3: Japanese Resident’s Activity in Foreign Bonds

Source: Morgan Stanley, Japan’s MoF

But the conclusion remains the same. If (when) there are no longer enough investors to buy the JGBs, or if (when) Japanese investors stop hedging their currency exposure when investing abroad, the pressure on JPY could become immense.

So get out of Yen while you can at around 80!

RMB Currency Trader. And I quote:

The Land of the Rising Sun has the dubious distinction of sporting the highest debt-to-GDP ratio of any industrialized nation in the world. Now greater than 200%, Japan’s relative debt load is bigger than that of Greece, Spain, Portugal or the US. Japan needs to borrow over 50% of GDP this year just to stay afloat, according to the International Monetary Fund (IMF), and its financing needs are expected to reach almost 60% of GDP next year. (See graph below.) Its strength has been somewhat befuddling, especially considering this growing burden of debt.

Why has the Japanese currency been so strong? Because despite all of the yen’s problems, Japan runs a trade surplus. Traders view that surplus as a source of funding which can be used to pay down Japan’s skyrocketing debt, making the yen seem like a “flight-to-quality” currency despite appearances. However, Japan’s strong currency is beginning to affect Japan’s ability to export. Competition from China and rising Asian powers such as Vietnam is also beginning to take its toll. Japanese industrial output fell 1.9% in September after dropping 1% in August.

To remind you why you should hate the Japanese currency, I’ll refresh your memory with this short list:

* With the world’s weakest major economy, Japan is certain to be the last country to raise interest rates.

* This is inciting big hedge funds to borrow yen and sell it to finance longs in every other corner of the financial markets.

* Japan has the world’s worst demographic outlook that assures its problems will only get worse. They’re not making Japanese any more (well just not very fast).

* The sovereign debt crisis in Europe is prompting investors to scan the horizon for the next troubled country. With gross debt approaching 225% of GDP, Japan is at the top of the list.

* The Japanese long bond market, with a yield of a scant 1%, is a disaster waiting to happen.

* You have two willing co-conspirators in this trade, the Ministry of Finance and the Bank of Japan, who will move Mount Fuji if they must to get the yen down and bail out the country’s beleaguered exporters.

When the big turn is inevitably confirmed, we’re going from ¥83 to the initial target of ¥85, then ¥90, ¥100, ¥120, eventually ¥150

Make sure you have Your Own PERSONAL pension plan!

The Toronto Sun reports, Canadian Feds have $65B pension funding shortfall:

The federal government has underestimated its employee pension obligations, exposing taxpayers to a $65 billion shortfall, according to a new report released Thursday by the C.D. Howe Institute.

Using fair-value accounting, the measure used in the private sector and based on solvency, the think tank calculated Ottawa’s net pension obligation stands at nearly $208 billion. That’s $65 billion more than reported in the public accounts.

The government lists its unfunded liabilities in the country’s national debt at $143 billion.

Taxpayers could be on the hook to back-fill the funding gap, the report by Alexandre Laurin and William Robson said.

On top of that, large exposure to public sector pensions could fuel fears of sovereign default driving up the cost of borrowing.

“The larger-than-reported gap between federal pension promises in these plans and the assets that back them is a problem, both for federal employees and for taxpayers,” the pair said.

But Canada is not alone. European and U.S. governments share the problem. The United Kingdom for instance is facing a $1.8 trillion shortfall and the U.S. has $3 trillion.

GOLD;

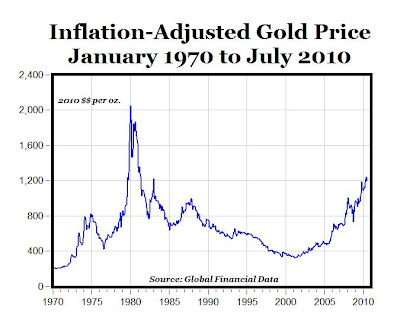

Personally I think we are only in the early stages of the mania phase, and this phase could last many, many years dependent upon the unparalleled consistent stupidity of regulators and rulers.

The Nasdaq chart on the left is a 12 year chart while the Gold chart is a 10 1/2 year chart. Both charts are monthly. The point in making both charts monthly is that you, I and everyone else can clearly see there is nothing close to even the beginnings of a blow-off top in Gold yet.

Give us a call on which gold fund is the best to invest in . . 03 5724 5100

9% plus return in GBP — Brandeaux was a pioneer in providing private student accommodation in the late 1990s, and is now one of the largest investors in the sector. The Fund has a geographically diverse portfolio across the UK, which totals over 15,000 beds in residences located in 18 major university towns and cities.

Brandeaux has developed strong university relationships and now has more than 60% of total rents secured under university nomination agreements.

Brandeaux has achieved 100% occupancy for the 2009/10 university year, as it has had for the last two years. The accommodation is marketed under the Liberty Living brand, which is synonymous with high quality and excellent levels of service. This has engendered good relationships with both universities and students.

| Fund | Share Price as at 31/08/2010 |

Total Return to 31 August 2010 | Average Annual Return Since Launch |

||

| Last 12 Months | 3 Years | 5 Years | |||

| Student Accommodation Funds | |||||

| Student Accommodation Fund (£) Launched 15 June 2000 |

£2.56 | +9.87% | +33.33% | +62.03% | +9.68% p.a. |

Get in touch today on how to invest 03 5724 5100 or info @ bannerjapan.com .

![[ROI_100524]](http://sg.wsj.net/public/resources/images/OB-IP413_ROI_10_NS_20100524192106.gif)