Sovereign Debt Crisis = Banking Crisis

Posted on by Armstrong Economics

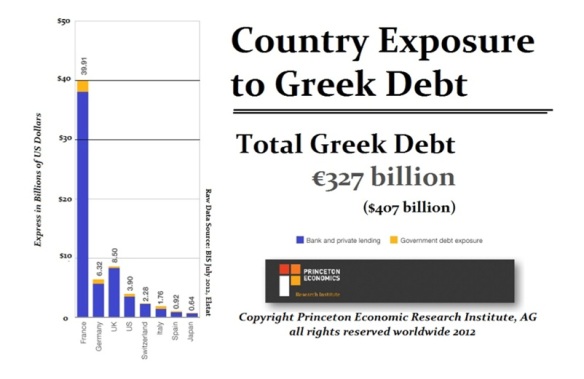

The Sovereign Debt Crisis is of profound importance. What is grossly being overlooked is both the exposure of banks to sovereign debt in Europe as well as Japan. In the case of the former, France has more exposure than all of Europe combined. The French have actually proposed lowering the retirement age from 62 to 60. This is like you see you are about to hit head on in a collision while driving so you just step on the gas to endure to end it all as fast as possible. If the Greeks do not blow up the Euro, don’t worry, the French will.

The French banks are in serious shape and now the Government will not back off of its insane socialistic policies. Just where is this money supposed to come from nobody knows.

In Japan, the same problem exists. The Japanese debt is going to crash and burn in 2013. This will be the first opportunity for a major low in Japan. It will be 23 years down. Expect the JGBs to crash, the yen to decline, and the Nikkei to finally rally after it makes new record lows in 2013. The Japanese bank exposure to Japanese debt is monumental. The slightest uptick in interest rates in 2013 will wipe out bond investors like we saw in 1931. This will push the dollar higher as capital flees and parks in the dollar. Eventually that will flip and the dollar will drop with the Sovereign Debt Crisis eventually migrating to the USA.

As far as where to put your money, well that will be good solid equities. Gold of course will provide the underground economy. So those buying gold, make sure it is in coin form not in banks nor in bar form. Gold is not headed for nonsense of $30,000 and ounce. If that ever happened, the troops would be hunting down gold door to door in the USA.

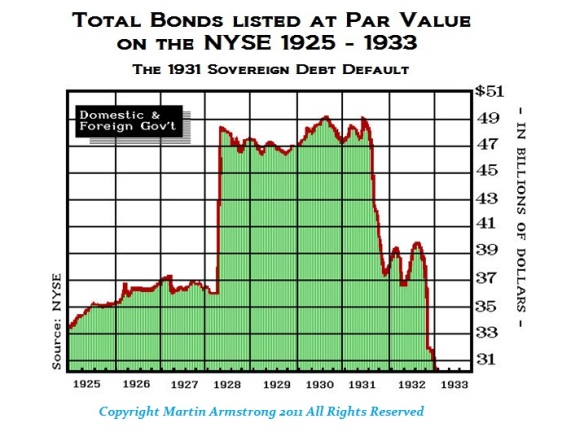

The Sovereign Debt Crisis defines everything. Just remember what happened to bonds in 1931. Here is a vivid chart because this data is usually suppressed.

Finance in Focus Dec. 2012 Thoughts

There are many predictions for the price of silver and gold. Some say silver will crash to nearly $20 and gold back under $1,200, and others proclaim silver $100 and gold at $2,500 by the end of 2012. The problem is that some predictions are only wishful thinking, others are obvious disinformation designed to scare investors away from silver and gold, and many are not grounded in hard data and clear analysis. Other analysis is excellent, but both the process and analysis are difficult to understand. Is there an objective and rational method to project a future silver price that will make sense to most people? Clearly Yes!

I am not predicting a future price of silver or the date that silver will trade at $100, but I am making a projection based on rational analysis that indicates a likely time period for silver to trade at $100 per ounce. Yes, $100 silver is completely plausible if you assume the following:

- The US government will continue to spend in excess of $1 Trillion per year more than it collects in revenue, as it has done for the previous four years, and as the government budget projects for many more years.

- Our financial world continues on its current path of deficit spending, debt monetization, Quantitative Easing (QE), weaker currencies, war and welfare, ballooning debts, and business as usual.

- A massive and devastating financial and economic melt-down does NOT occur in the next four to six years. If such a melt-down occurs, the price of silver could skyrocket during hyperinflation or stagnate under a deflationary depression scenario. (best candidate for hyperinflation = JAPAN)

Same is true for $2,500+ gold prices.

USA National debt projections: by 2020 it will be over 20+ TRILLION

http://en.wikipedia.org/wiki/File:CBO_-_Public_Debt_Scenarios_-_June_2011.png

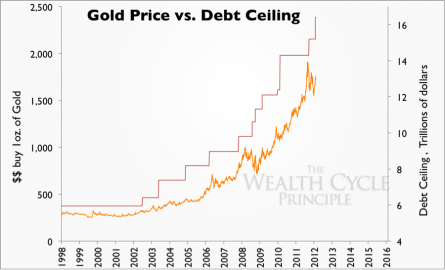

Also, With a debt to GDP ratio now at 105%, the U.S. crossed the significant 100% threshold around the beginning of the year. The deeper into debt the U.S. and other countries around the world go, the less valuable the dollar and all paper currencies become—and the higher the value for gold.

We may be skeptical of price projections for silver and gold, but projections for national debt are quite believable. Since the correlation is very close, future silver prices can be projected, assuming continuing deficit spending, QE, and other macroeconomic influences. A dollar crash or an unexpected bout of congressional fiscal responsibility could accelerate or delay the date silver trades at $100, but the projection is reasonable and sensible. Silver increased from $4.01 (November 2001) to over $48 (April 2011). A silver price of $48 seemed nearly impossible in 2001, yet it happened. An increase from about $32 (October 2012) to $100 (perhaps in 2015 – 2016) especially after Bernanke’s recent announcement of QE4-Ever.

All this makes $100+ silver and $3,500+ gold seem very possible.

What changed in the last 30 days?

Did the world just wake up to the idea that the only way out of this quagmire is a twisted currency war that appears to have re-ignited thanks to Abe’s efforts? Something appears to have snapped in the American psyche as the last 30 days have seen the largest physical gold sales on record. We fear something is afoot and while Congress fiddles as our economy burns, Bernanke going ‘back to work’ is perhaps what the physical ‘horders’ are thinking… or maybe they understand, that just as Kyle Bass has confirmed previously, Paper Gold is just like allocated, unambiguously owned physical bullion… until it’s not.

(Source: US Mint)