Investment Advice: A Review

http://bccjacumen.com/features/e-bulletin-exclusive/2013/02/investment-advice-a-review/

Financial advice. A perplexing subject. Let’s start with the negatives:

i) markets are inherently unpredictable, chaotic in the technical sense of the word, and we can’t know what the future will bring

ii) therefore financial planning is a vexed endeavour with plenty of scope for error

iii) there are not a few shysters out there peddling financial ‘advice’, lamentably with no further objective in view than their own self-interest.

To which we can rejoin:

i) it’s the nature of the beast

ii) not to make financial planning decisions is to make a financial planning decision. Normally this involves storing earned cash as cash. And longer term, with government printing-press assistance, stored cash is the worst financial asset of them all

iii) there are decent and competent advisers out there. It’s important to find one because even with a modicum of financial nous and the willingness to spend the time on research and analysis, most people are their own worst adviser. Personal planning decisions are more likely to suffer myopia and greed- and fear-induced blunders without third-party perspective and relative impartiality.

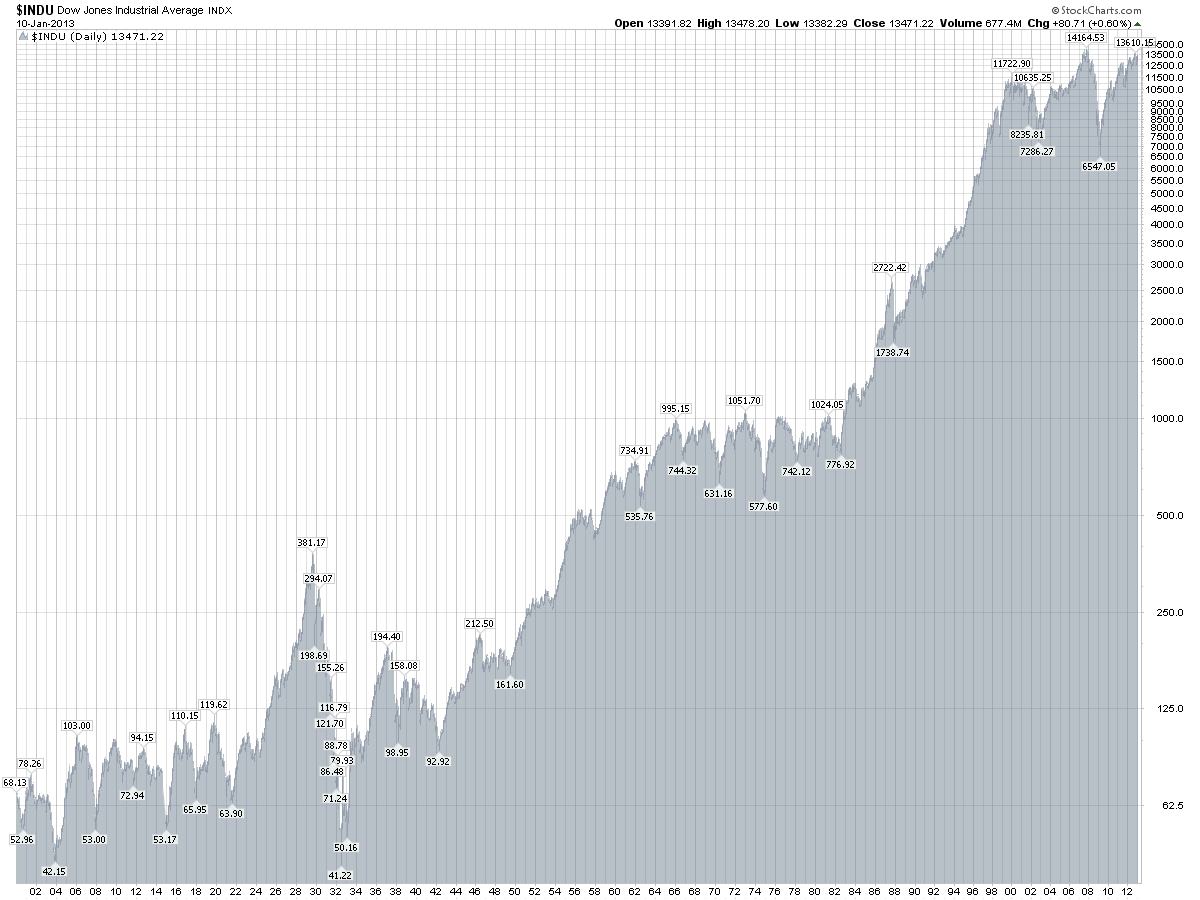

As an example of perspective, we could ask, at the present juncture, why is there so much pessimism out there as the world’s stock markets approach, or exceed their 2000 and/or 2007 highs? The fear perhaps that this rally will also fail? Most people know the problems have not gone away. A failure is probable as the rally has been bought with central bank money created out of thin air, and all the while, since 2009, stock market volumes have been declining —true bull markets are built on rising volume. But let’s look at the big picture, say 100 years, which shows:

- a bull market from 1921 into 1929,

- a massive bear market in which stocks did not recover their tone until 1949

- a bull market into 1966

- a sideways bear market (with inflation devaluing money by 75%) into 1982

- a bull market into 2000

- a roller-coaster bear market until the present.

The bear market is not yet over, but it will be, let’s guess sometime in the second half of this decade. No doubt, as the fiat-created money eventually makes its way out of the banking system, it will manifest itself as frisky and eventually galloping inflation.

Which scenario yields three important conclusions:

1) accumulate precious metals, patiently on dips over time

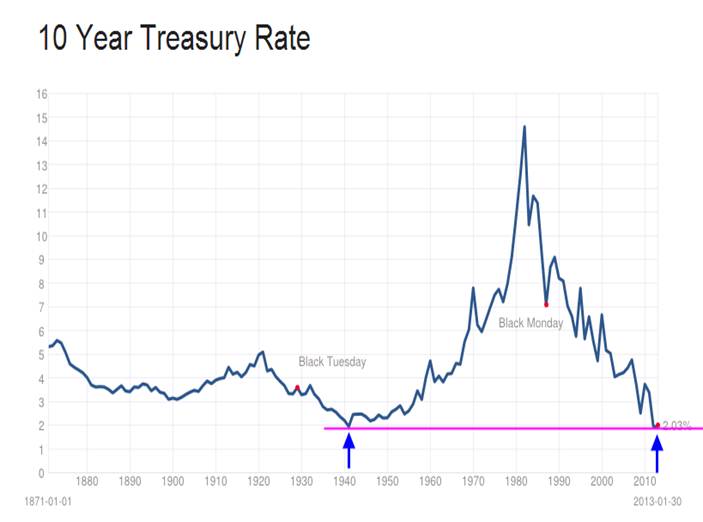

2) the bull market in bonds, initiated by Paul Volcker back in 1979, is just about over and for the foreseeable future first-world government bonds are guaranteed certificates of confiscation.

3) the way to handle stock markets is stylistic: either move to the sidelines and then to bear instruments, or grit your teeth and average your way through the oncoming decline, because no matter how far down markets go, the prospective recovery (and yes there is always a recovery) will magnify all those bargain-priced units you have purchased on the way down.

At the same time, perhaps you should ask yourself when did you last put your own financial situation through an objective review ? It’s true there are fewer advisers in Japan than there were in 2007 and 2008. The depletion is no bad thing as the ones no longer here are no longer here for substantive reasons.

Shyster-detecting questions you may ask in vetting a potential adviser:

i) Do they have an office inJapan? (i.e. not working from home/a coffee shop nor jetting in from Bangkok, Hong Kong or Labuan or Manila etc.)

ii) How long have they been in operation / in Japan, and how long is it since they last changed their name?

iii) Are they Japan FSA regulated?

Finally, the consultation should be for free and with no obligation.

These are important considerations, especially now that recent currency moves have made the thoughtful application of a still strong but obviously declining Yen an urgent consideration.

By Chris Cleary and Trevor Reynolds from Banner Financial Services Japan. www.bannerjapan.com

TAX: Residents of Japan with assets held overseas worth over JPY50 million

In 2013 there is an effort to ensure that the taxable income arising from overseas assets is correctly and fully disclosed. Residents of Japan with assets held overseas worth over JPY50 million will be required to file a report disclosing those assets to the tax authorities. This new requirement is in addition to the “5 year rule” where all foreigners are taxable on their worldwide income after they have lived in Japan for 5 years.

Reporting requirement

By 15 March of each year a Japan-resident taxpayer who holds overseas assets with a fair market value of more than JPY50 million as of 31 December of the previous year will be required to file a return declaring those assets. The first report will be due in March 2014 for assets held at 31 December 2013.

The location of assets is to be determined using the regulations applicable to inheritance tax. The table below shows the location for commonly held assets.

| Asset | Location |

| Immovable assets | Physical location of the asset |

| Cash deposits | Address of the branch where deposits are held |

| Bonds/Shares | Address of the head office of the issuer |

As a result the report will not only identify undeclared sources of foreign income, but could also be used in identifying overseas assets for inheritance tax purposes.

Penalties for non-compliance

The penalties for non-compliance are similar to those for the share based remuneration requirements above. If a taxpayer fails to file the report or deliberately files a false report, they a face a penalty of either a maximum of one year in prison or a maximum fine of JPY500,000. These penalties will apply to the second reporting period (for assets held at 31 December 2014) onwards. In addition the usual penalty for non-disclosure of income will be increased by 5% to 15% in cases where the underlying asset is not disclosed in this report. If the asset is disclosed, the penalty is reduced to 5% of the income.

Summary

The information disclosed in this report will aid the tax authority not only in identifying overseas sources of income, but also in ensuring that inheritance estates straddling multiple jurisdictions are fully disclosed. This is another sign of the increasingly aggressive stance the tax authority is taking to cross-border inheritances.

Banner Japan is able to assist with the setup of a variety of Japan tax compliant structures and solutions — call us today for a free consultation on what we can do to shield and grow your assets. Also it is always best to start planning early even if you assets are not quite yet at 50m.

These solutions and structures will also shield you from the “5 year rule” too – contact us now and we can have a discussion to minimize your Japan tax exposure.

Finance in Focus Feb 2013; Sign Posts

http://www.facebook.com/pages/Banner-Financial-Services-Japan/100998180008073?ref=hl

Investing is not easy one has to be constantly looking for sign posts and directions from the ever moving, ever changing massive organism called the markets. There is never one thing that is the “oh that’s it” but even where there seems to be it is often opaque and always debatable. There is never a perfect solution and we don’t have the advantage of hindsight – ever- in investing.

So what are the latest sign posts we should be paying attention to?

Here in Japan current sign post is definitely “Abenomics” and the wish for 2% inflation. It is often said “be careful what you wish for”, as with 2% inflation one will get increased interest rates. If interest rates were to increase from the low levels here in Japan to say 2% this would mean japan would be spending more than 70% of the ENTIRE TAX revenue currently to just pay the interest on the continually rising debt! So we watch and wait for the next sign post which will be the upper house elections, should Abe and the LDP win, then the “Let’s Destroy Party” may actually get its wish, the problem being they do not know what they are going to get. Likely a much, much weaker Yen and a structurally changed economy. Why? you may ask. China and Japan are posturing for political gains – However China used to buy 20% plus of Japan’s exports now this is clearly declining and being replaced by purchases elsewhere – this is a structural change that will very likely not change back. Just another problem to add to Japan’s ever growing list of economic woes.

The next sign post is the US debt ceiling – however, one we think will be just simply raised with no meaningful debt reduction. We wait to see what happens but unless the Republicans do something this will just be kicked down the road. The S&P has broken 1,500 again third time now the others were in 2000 and 2007 . . . will this be a third time lucky or are we getting very toppy on declining volumes? Declining volumes are never the sign of a healthy rally and they have been declining for four years.

The European sign posts are many, however the big one is the September German elections. Will Merkel win? If she does not who will the new government be and will they have an Anti-EU stance? I.E. no monetary union . . .

The Gold comment we made in July last year still holds — GOLD — 2012~2017

Gold is not going to go up because of all the conspiracy claims nor because the real gold will conquer the paper gold. This is all about reality. Gold is a viable part of the portfolio. It will rise to the occasion when the timing is right. The very people accused of keeping it down are the very people who will turn around and send it up as well. This is just about time. Nothing more! When the time is right and people realize that the Governments have no Clothes, look out there will be a stampede at that time. For now, that still appears headed into 2015~2017.

Gold is neutral and the next turning point will be a big one. Monthly closing resistance remains at 1755 and the primary resistance for the next 6 months is still 1807. The primary support lies at 1570 and 1480. Thus, as long as gold remains within 1807 to 1480 (Sign Posts), it is effectively neutral, so slowly and patiently accumulate!

Gold is a good investment NOT because of all the fiat nonsense, but because inflation has passed it by and there will be a huge burst of price movement. That will come when the Sovereign Debt Crisis hits the USA and that does not seem likely until the autumn of 2015.

One theory as to why gold prices aren’t bounding above $2000 is simply this: the central banks have so far failed to produce any meaningful inflation. The untold trillions worth of stimulus they have shot at this goal have barely kept deflation at bay. Granted, prices for groceries, health care and some other necessities have gone up (outside Japan). But the inflationary impact of all of these things together is inconsequential in comparison to the deflationary down force of a quadrillion dollar financial edifice that remains in a state of incipient collapse.

Please feel free to get in touch and discuss any topic on savings and investing and how to get your YEN working.

Sovereign Debt Crisis = Banking Crisis

Posted on by Armstrong Economics

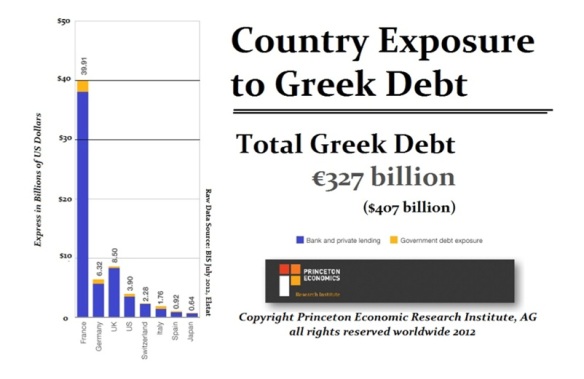

The Sovereign Debt Crisis is of profound importance. What is grossly being overlooked is both the exposure of banks to sovereign debt in Europe as well as Japan. In the case of the former, France has more exposure than all of Europe combined. The French have actually proposed lowering the retirement age from 62 to 60. This is like you see you are about to hit head on in a collision while driving so you just step on the gas to endure to end it all as fast as possible. If the Greeks do not blow up the Euro, don’t worry, the French will.

The French banks are in serious shape and now the Government will not back off of its insane socialistic policies. Just where is this money supposed to come from nobody knows.

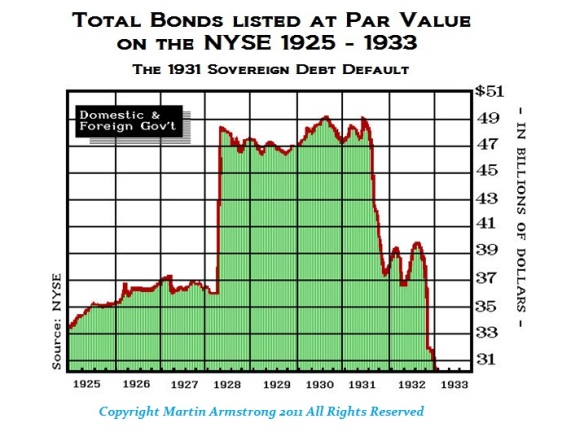

In Japan, the same problem exists. The Japanese debt is going to crash and burn in 2013. This will be the first opportunity for a major low in Japan. It will be 23 years down. Expect the JGBs to crash, the yen to decline, and the Nikkei to finally rally after it makes new record lows in 2013. The Japanese bank exposure to Japanese debt is monumental. The slightest uptick in interest rates in 2013 will wipe out bond investors like we saw in 1931. This will push the dollar higher as capital flees and parks in the dollar. Eventually that will flip and the dollar will drop with the Sovereign Debt Crisis eventually migrating to the USA.

As far as where to put your money, well that will be good solid equities. Gold of course will provide the underground economy. So those buying gold, make sure it is in coin form not in banks nor in bar form. Gold is not headed for nonsense of $30,000 and ounce. If that ever happened, the troops would be hunting down gold door to door in the USA.

The Sovereign Debt Crisis defines everything. Just remember what happened to bonds in 1931. Here is a vivid chart because this data is usually suppressed.

What changed in the last 30 days?

Did the world just wake up to the idea that the only way out of this quagmire is a twisted currency war that appears to have re-ignited thanks to Abe’s efforts? Something appears to have snapped in the American psyche as the last 30 days have seen the largest physical gold sales on record. We fear something is afoot and while Congress fiddles as our economy burns, Bernanke going ‘back to work’ is perhaps what the physical ‘horders’ are thinking… or maybe they understand, that just as Kyle Bass has confirmed previously, Paper Gold is just like allocated, unambiguously owned physical bullion… until it’s not.

(Source: US Mint)

SIGNS OF THE TIMES

“Indian Industrial Production Unexpectedly Fell in September”

– Bloomberg, November 12

“Economic output in the Eurozone fell 0.1 percent in the third quarter, following a

0.2 percent drop in the second quarter.”

– Reuters, November 15

“China’s vehicle sales fell for the sixth straight month in October.”

– Bloomberg, November 14

“Investment Falls Off a Cliff”

– Wall Street Journal, November 18

This story included that U.S. companies were cutting spending plans because of

“fiscal and economic uncertainty”.

Then there are two gems that really mark growing uncertainty:

“Krugman: Bring Back the 91% Tax Rate”

– The New York Times, November 18

“Treasury Secretary Geithner: Lift Debt Limit to Infinity”

– CNS News, November 19

Harvesting headlines is usually interesting and sometimes riveting. The first ones indicate a

slowing global economy – despite unprecedented stimulation, corporate bailouts and “fixing”

of any number of countries.

The problem in any post-bubble contraction is that in the mania debt was eagerly expanded to

an amount that can’t be serviced even by a strong economy. The debt burden seems to be the

main reason that post-bubble recessions are severe and recoveries are weak.

The last two headlines suggest that the establishment is discovering that massive intervention

is not prompting a strong business expansion. The proposed remedies of higher tax rates and

unconstrained issuance of treasury debt indicate that confiscation of wealth and earnings is

changing from a hidden to an open agenda. Intellectually pathetic and fiscally tragic.

PIVOTAL EVENTS – NOVEMBER 22, 2012

BUY GOLD