Gold standard and what happens without it!

Gold, up until the Bretton Woods Agreements of 1944, figured as the complement to the international exchange of merchandise or services and did settle outstanding balance of payments deficits, because it was a merchandise or commodity used as money.

According to the Bretton Woods Agreements, the fiduciary dollar was accepted as being as good as gold, with trust on the part of Central Banks upon the ability to redeem the dollar into gold. From 1944 up until 1971 then, these fiduciary dollars were held in Central Bank reserves as a credit call upon US gold; the final payment had not been effected and was delayed as a credit granted to the US until the dollars held in reserves were to be cashed in for gold at some future date.

As it turned out, the “fiducia” or “trust” was misplaced, for in 1971 the US reneged on the Bretton Woods Agreements of 1944, “closed the gold window” and stiffed the creditor countries. No final settlement of international commerce debts took place in 1971, nor has any taken place since then; the truth of this statement is obscured by the mistaken idea that tendering a fiat currency in payment of an international debt constitutes settlement of that debt.

Once that false idea – that fiat money can settle a debt – is accepted as valid, then the problem of the enormous “imbalances” in world trade becomes an insoluble enigma. The best and brightest of today’s accredited economists attempt in vain to find a solution to a problem that cannot be solved except by the renewed use of gold as the international medium of commerce.

Regarding national commerce, the same reasoning applies. In reality, no one engaging in commerce in any country in the world today is actually paying for purchases, that is to say, there is no any actual settlement of any debt. All individuals, corporations and government entities are merely shuffling debts (payable in nothing) between themselves, in the form of either paper bills or digital banking money, whether in dollars or any other currency in the world.

IMF Sells 15.1 Metric Tons Of Gold In April

The IMF has announced its gold reserves declined to 2,966.4 in April from 2,981.5 tonnes in March, a 15.1 ton decline. And while the IMF sold well over half a billion worth of gold in April, Russia was once again taking advantage of what some are calling firesale prices, bulking up its gold holdings by 5 tonnes, which increased from 663.7 to 668.7. Russia has now been adding gold every month since February. As has long been known, in 2009 the IMF announced it would sell 403.3 tonnes of gold, of which 212 was purchased in prearranged deals by India, Mauritius and Sri Lanka. This means the IMF, after accounting for all disclosed sales, has 152.1 tonnes of gold left to sell from its original quota. Bloomberg discloses who has been doing the most buying recently: “Central banks and governments added 425.4 tons last year to 30,116.9 tons, the most since 1964 and the first expansion since 1988, data from the World Gold Council show. Official reserves may expand by another 192 to 289 tons this year, according to CPM Group, a research and asset-management company in New York.” Keep your eyes on Russia: “Russia’s central bank bought 142.9 tons of gold last year, raising its holdings of the metal by 29%, RIA Novosti reported last month, citing Bank Rossii’s annual report submitted to parliament.”

Gold is taking the news in stride.

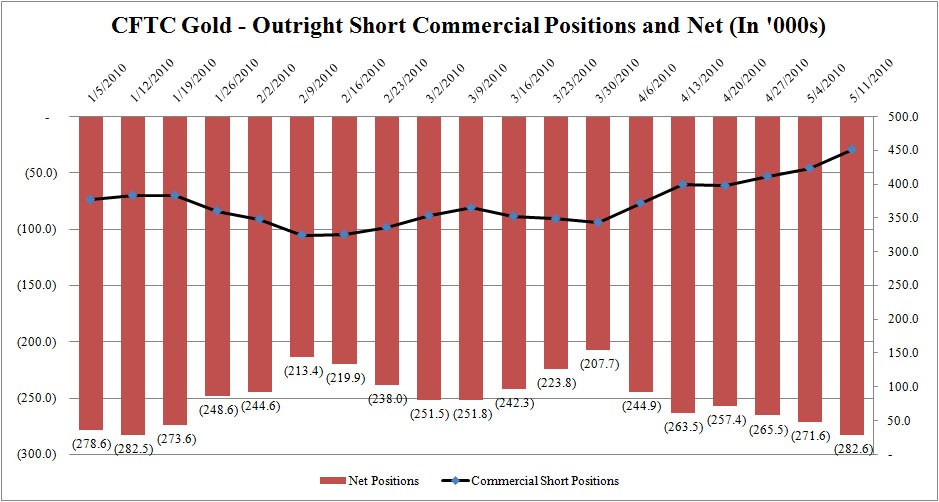

Gold Commercial Short Positions Hit All Time High

Zerohedge comment

In addition to the EUR data in today’s CFTC Commitment of Traders report, another data point that caught our eye is the record exposure in outright commercial shorts in gold: this week they hit an all time high of 450,950. It appears that last week the desire to suppress any gold breakouts was at historic highs, even as net commercial exposure hit a 2010 low of -282.6, just slightly higher than that seen in the second week of January. If even with this massive onslaught to keep gold low by the LBMA, the precious metal managed to nearly hit $1,250 today, what will happen to gold when the 450k commercial positions are forced to cover?

Why you should buy Gold.

Fundamental Reasons Gold Will Soar

You Can’t Ignore Inflation: The 2008 stock market panic sent stock and commodity prices – including the price of oil – into a tailspin. And that launched the big debate about whether inflation or deflation would ultimately carry the day. Keep in mind that since 2001 – under benign price inflation of roughly 2.5% – gold has managed to rise about 400%. Meanwhile, the U.S. Federal Reserve is widely expected to keep short-term rates near zero through this year, leaving the door open for inflation. In addition worldwide, central banks have rolled out an unprecedented $12 trillion worth of stimulus programs, with some of the money still to be spent. Inflation is coming just don’t know when . . .

Inflation explained: When the economy goes down, people save more. When that happens, circulating M2 (money) also goes down because less people are spending. That would make the economy even worse, so what the government does, is it borrows money from the Fed, which makes money out of absolutely nothing, and then lends it to the government at interest. Then this new money sort of replaces the saved money, and the recession should hopefully not get worse.

Then, once things are better, this new money which eventually floats around is deposited at banks. Banks then use this as high powered money to create more money from thin air. About 90%, so, you deposit, $10,000, the bank can lend $9000. This isn’t YOUR $9000, it is brand new money. Your $10,000 is still there, this process doesn’t end there. Now there is $9000 of new money in the economy. That then gets deposited at another bank. Now that bank can lend $8100, and so on until about $90,000 is effectively created out of thin air!

That’s why the bailout of $700B will eventually reach about $7 Trillion. (This will expand the money supply around 30% to 50 %.) The money hasn’t been “unlocked” yet (banks are not lending). So, once the economy picks up again, and it’s going to need employment for the money to be unlocked, we could see a lot of inflation; maybe even 10% a year for a few years.

Investment Demand is out there: Large institutional investors – hedge funds and pension funds – are making large allocations to gold, as are individual investors. The proliferation of gold-focused exchange-traded funds (ETFs) bears this out. The SPDR Gold Trust (NYSE: GLD), the world’s largest physically backed ETF with 1,100 tons of the lustrous metal, is the sixth-largest holder of gold bullion. Individual investors have never had an easier avenue for owning gold. (However maybe this is not the best way as it is not 100% backed)

Asia, with a population that exceeds 2.5 billion inhabitants and a long-standing cultural affinity for gold, is stoking global demand in a big way. China is encouraging its citizens to buy gold and silver.

Central Banks are Becoming Net Buyers: India’s recent purchase of 200 tons of International Monetary Fund (IMF) gold was the likely impetus that pushed gold up over the $1,200 level in December. But more important is the sea change that has seen central banks change from net sellers into net buyers of gold. BlackRock Inc. one of the world’s largest investment managers, said that 2009 was that turning point. If that was the case, it will have been the first time in 20 years, as central banks have been net sellers of gold since 1988.

A Currency Crisis is Looming: The “PIGS” – Portugal, Italy, Greece and Spain (or “PIIGS,” if you want to include Ireland) – aren’t in very good fiscal shape. And they aren’t alone. Iceland has already gone over the edge. The United States, the United Kingdom, and countless other economies are struggling. And that reality has ignited a crisis of confidence about fiat currencies in the minds of many investors. Money is nothing more than paper and ink, backed by the full faith and credit of the issuer. When investors find that their faith in the issuer is shaken, the value of that currency erodes. Additional sovereign-debt downgrades from ratings agencies are but one potential trigger of a currency crisis. Under such conditions, gold – the ultimate store of value, and the oldest existing form of money on earth – will soar as investors seek to protect their purchasing power.

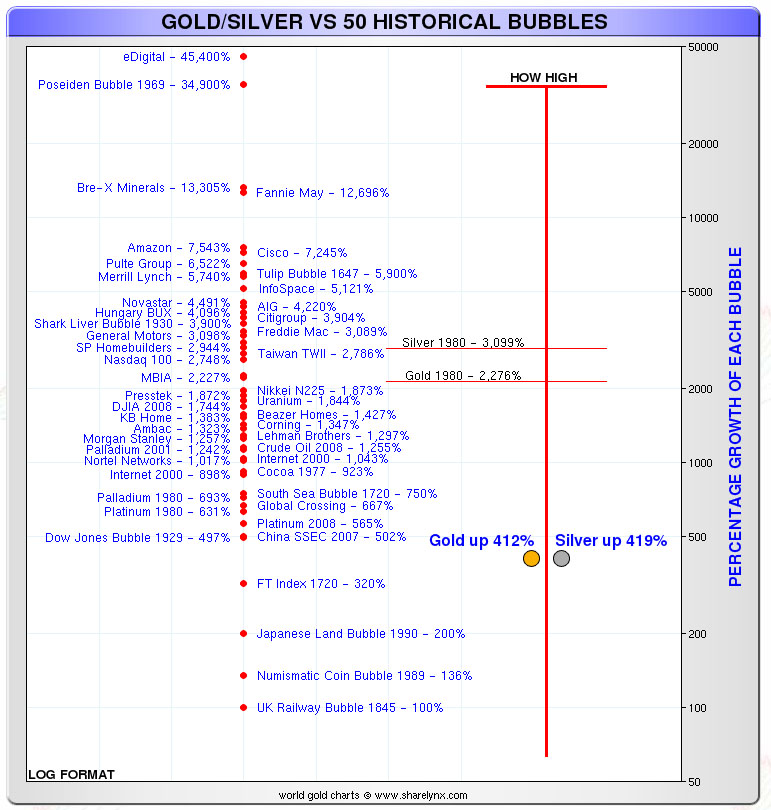

We’ve Yet to Reach the Mania Stage: the gold bubble that takes prices to all-time-record levels will inflate in three distinct stages. This process will start with currency devaluations in Stage One, will be fueled by growing investment demand in Stage Two and will experience its stratospheric ascent in Stage Three, the mania phase of this evolution. Keep in mind, the entire gold industry has an aggregate market capitalization (value) below that of Wal-Mart Stores Inc. (NYSE: WMT) alone (currently about $210 billion). So as the crowd piles in, the “big money” to be made will lie with gold explorers and producers, where 1,000% returns will not be uncommon, even from today’s prices.

All these fundamentals underscore that gold prices have plenty of room to run from here. All the physical gold in existence is worth somewhat more than $1 trillion US dollars while the value of all the publicly traded gold companies in the world is less than $100 billion US dollars. When the fundamentals ultimately encourage a strong flow of capital towards gold and gold equities, the trillions upon trillions worth of paper money could propel both to unfathomably high levels.

It’s Time to Make Your Move

Everyone needs some exposure to gold in their portfolios, no matter their age or risk tolerance. Owning some physical coins or bars makes sense.

When will gold really take off? I think it will take a few years. But with bubbles, or speculative frenzies, one never knows. Just this week, in fact, Robert R. McEwen, the chairman and chief executive officer of U.S Gold Corp. (AMEX: UXG), predicted that gold could more than quadruple to hit the $5,000 level by 2012. Some experts have labeled this expected move as a looming “super spike.”

Despite the mania stage (we think) is still several years away, the wise investor recognizes both the importance and the potential of investing in gold.

I have no doubt that today’s $1,100 gold price level will eventually, in hindsight, look like an outrageous bargain.

WAYS TO OWN GOLD

There are many ways to own gold. The best way is to buy a few one-ounce gold coins, preferably American eagles if you’re in the United States, or Canadian maple leaf coins if you’re in Canada. With one-ounce coins, you pay the lowest commission. The trouble with gold coins is also their advantage: they are in your possession. They can be lost or stolen. They must be mailed back to a coin dealer to sell them for money. There are commissions to pay. But, in a time of national crisis, coins are the best way to hold gold for the small investor.

You can buy gold shares – a very good idea. This is the standard approach of most investors an easy way would be with GDX or GDXJ – exchange traded funds. There are gold miner shares on almost every exchange.

There is a Fund which invests 60% of its assets into physical gold the other 40% is invested in Managed futures which since 1990 has achieved returns of over 17% pa.

There is a fund, the Central Fund of Canada, that holds mostly gold and some silver bullion. The prices of the two metals move in tandem most of the time. Owning shares of this fund is a surrogate for owning physical gold. This is far better than GLD as there you are buying paper and not all the gold is actually there!

Always remember: if there is no proof of physical possession of gold, and if there are no storage charges for gold held in reserve, then you may be trading a futures contract, which is a promise to pay gold on demand. Promises to pay are never as reliable as gold in hand. Third-party verification of gold held against receipts issued for gold becomes important.

You should ask yourself what you are hedging against. Answers include the above fundamental reasons in the report, plus these more specific ones:

- Dollar inflation/depreciation

- Terrorist attack on the U.S.

- Crisis in the bank payments system (cascading defaults)

- Speculation: Asians may start buying gold

WHAT IS THE DOWNSIDE RISK?

The standard ones are these:

- Net central bank sales of gold to public

- Recession reduces price inflation

- Recession reduces demand for commodities

- Asians turn out to love paper money more than gold

- Governments outlaws gold

- Gold-owning people actually obey the governments

The political pressure is very strong to keep a higher price of gold from identifying reduced confidence in the dollar. We have seen the government take steps to push down gold’s price. But the government also sells gold coins. It maintains the official position that gold is not relevant for monetary affairs. To outlaw gold would be to admit that gold is relevant. This might turn into a gold-buying panic. Because people can easily buy and sell gold on the Web, there are ways for people to evade the law.

A worldwide recession is possible if China suffers a major recession. China at some point will have to go through a recession because of today’s inflationary policies. But the question is: When? Gold may fall 30% from $1,100 an ounce if it does buy some more. If you have no gold, it’s not wise to bet the farm on a fall in price. Besides, if gold falls, you’ll probably think, “It’s going to fall even more. I had better wait.” The Greece situation is the next thing to happen will they or will they not be bailed out, but really the bigger situation is who is next as Greece is about as relevant to the European economy as say Utah is to the USA. Now what happens when California needs a bailout it is the 8th largest economy in the world on its own. Then longer down the line there is Japan the third largest economy . . . and in the end the USA.

CONCLUSION

People postpone doing what they don’t really want to do. They don’t want to take action that implies that the present system is shaky, that the government is following policies that will debase the currency, and that there is no way for the government to preserve the purchasing power of the dollar by anything other than ceasing all monetary expansion, which the Federal Reserve System never does.

Central Bank Gold Holdings Expand at Fastest Pace Since 1964

Central Bank Gold Holdings Expand at Fastest Pace Since 1964

March 18 (Bloomberg) — Central banks added the most gold to their reserves since 1964 last year amid the longest rally in bullion prices in at least nine decades, data compiled by the World Gold Council show.

Combined holdings rose 425.4 metric tons to 30,116.9 tons, an increase worth $13.3 billion at last year’s average price, according to the data. India, Russia and China said last year they added to reserves. The expansion was the first since 1988, the data from the London-based council show.

Central banks, holding about 18 percent of all gold ever mined, are expanding their holdings for the first time in a generation as investors in exchange-traded funds amass bullion as an alternative to currencies. Holdings in the SPDR Gold Trust, the biggest ETF backed by the metal, are at 1,115.5 tons, more than the holdings of Switzerland.

Buy Gold While Supplies Last, Says Fund Manager

Peak Gold? Gold production from mines is not adequate to meet demand. Production is dropping around the world. Holmes notes worldwide production ell 10% in 2008 and is especially dramatic in South Africa – the world’s largest producer.

The Pension Challenge

A growing challenge for many nations is population ageing. As birth rates drop and life expectancy increases an ever-larger portion of the population is elderly. This leaves fewer workers for each retired person. In almost all developed countries this means that government and public sector pensions could collapse their economies unless pension systems are reformed or taxes are increased.

The Japanese Pension System is only available once you have paid into the system for 25 years, assuming they have your records! Even so this is only for the basic subsistence level, if you could call it even that, as it is below poverty line income.

So what should one do? As always DIY – there are many very easy ways to start savings. One is to sign up for a portable pension plan. This will be a minimum of five years but is best aimed at your earliest foreseeable retirement age. This will normally be between 55 and 60. You also agree a monthly amount to put away. The more you put into the plan, the more there will be for your retirement. However, you should not take on an obligation you cannot fulfill.

It is very easy as one can contribute using a credit card – this is convenient, is cheaper than using a bank to make transfers, and after a few months you don’t really notice the money going out. Your monthly contribution is then invested into a series of mutual funds. Doing things this way gives you advantages:

Access to diversified range of funds. The days of opaque mystery funds and lack of choice are long gone. You can be in range of funds which will sustain overall performance and cushion you from the gyrations of the markets. Yes, you can be in a wide variety of stock funds; you can also be in high-grade or high-yield bond funds, in gold stocks, in resource stocks, or in property income funds. Diversified portfolios do better in the long run.

Dollar cost averaging means investing a fixed amount at fixed intervals of time. That’s a sensible approach, for example, if it means committing yourself to investing a fixed amount of your salary every month toward your retirement. Dollar Cost Averaging is nothing more than the systematic investment of a fixed dollar amount at regular time intervals. However, once you initiate the plan, the key to success is sticking with it and ignoring market fluctuations. This is part of the investing puzzle that allows you to invest with more aggressive and volatile funds such as China, India, Latin America, Eastern Europe etc. as they hold over 2/3 of the worlds population and they will overtake the current leaders but there will be bumps which cost averaging will help you benefit from. For Example, you could invest $1,000 every month ($12,000 a year) not that much really when you think about it’s about $33 a day.

(If one did $12,000 a year for 15 years and got 10% return this would be become about US$419,000, however if you then left this for a further 15 years and did not add anything it would grow to become about US$1,750,000 – the power of time and compound interest.)

Please get in touch with us here at Banner and we can start your savings off on the right track. Please get in touch on 03-5724-5100 or info@bannerjapan.com