A few noted deflationists are calling for a top in commodity prices. Their argument is pretty simple: Because inflation is a function of available money plus credit (their definition), and because credit has fallen, deflation is what comes next. When looking about for things to deflate in price, commodities are an obvious candidate for attention because they have risen so much over the past decade.

In this view, three things have to be true:

1. Demand for commodities has to fall below supply. After all, as long as demand exceeds supply, prices will typically rise. (Wrong: no excess supply)

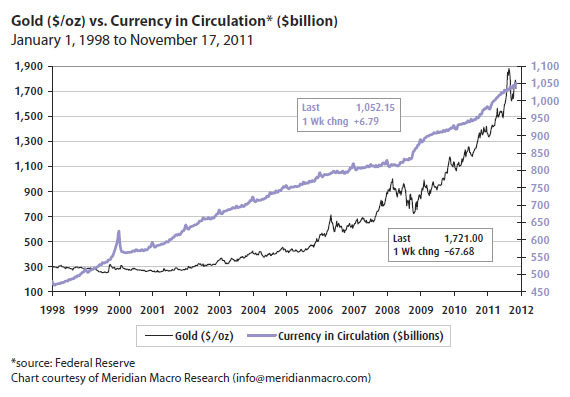

2. Money, including credit that would normally be used to buy commodities, has to shrink. That’s the definition of deflation that we’re analyzing here. (Wrong: look at M1 it is increasing; banks are not lending)

Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output. -Milton Friedman, The Counter-Revolution in Monetary Theory (1970)

3. People’s preference for money has to be greater than their preference for ‘things,’ with commodities being very obvious ‘things.’ That is, faith in money has to be there or people will prefer to store their wealth elsewhere. (I believe this is happening now, why keep cash? you get ZERO return for it)

These are all just versions of the old supply/demand argument for commodity prices, except that our consideration also includes the important element of the Austrian economic view of demand for money.

There are several reasons why I think there are serious holes in each of these conditions. Enough to warrant a healthy degree of caution in one’s certainty about what ‘must’ happen next to commodity prices.

Looking at Gold and deflation opinions over the years

1. Adam Hamilton of Zeal LLC wrote, anything typically financed by debt is likely to see its prices plunge dramatically, like houses and cars, as the ongoing Great Bear bust continues to destroy the gross excesses of debt via higher long rates. Conversely, anything not typically paid for with debt, including groceries and general living expenses, is almost certain to rise in the coming years. We are staring down a brutal environment of widespread inflation marked by various sectors witnessing falling prices as debt leverage implodes. See entire article here.

2. Castrese Tipaldi wrote on SafeHaven.com, I don’t know if in the last week we saw the last gasp of those usual subjects trying to cap gold, and I don’t know if we now have the very last possibility to get silver at a price so cheap. What makes this quote so interesting is he wrote this on April 20, 2004. See article here.

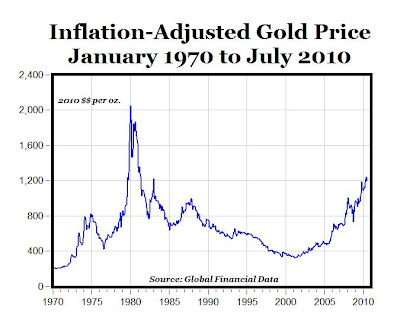

3. Dan Ascani, who wrote essentially about Professor Jastram’s very long-term study on gold, and he essentially states that Jastram studied four pronounced price deflations taking place. In all four deflations, operational wealth in the form of gold appreciated handsomely. When one sees that just by holding gold for 13 years, from 1920 to 1933 operational wealth would have increased two and a half times, one realizes that gold can be a valuable hedge in deflation however, a poor one in inflation.

4. Dr. Marc Faber one of the most respected and best followed in the industry has stated his opinion on the deflation debate as follows: Therefore, under both scenarios stagflation or deflationary recession gold, gold equities, and other precious metals should continue to perform better than financial assets. See article here.

5. Steve Saville of the Speculative Investor writes, The most important difference between then (the 1930s) and now is that gold and cash US dollars were interchangeable during the early 1930s (the deflationary period) by virtue of the fact that the dollar was defined as a fixed weight of gold. A typical effect of deflation is an increase in the purchasing power of cash. The fact that gold and cash were officially linked during the 1930s meant the deflation caused the purchasing power of gold to increase along with the purchasing power of cash. In other words, under the monetary system that was in effect during the 1930s gold was a hedge against deflation. Furthermore, under such a system the purchasing power of gold would decrease during periods of inflation; that is, when the dollar was defined in terms of gold, it would have made sense to shift investment away from gold during periods of inflation.

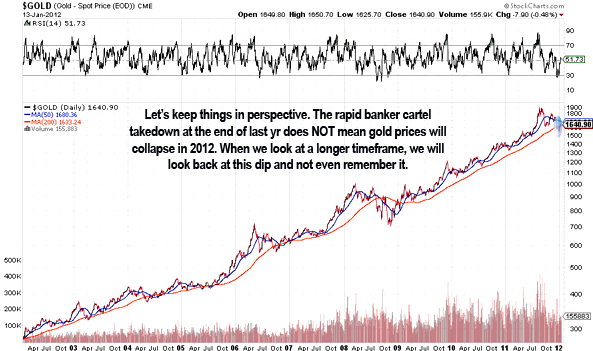

Currently it seems the physical markets are taking control, yet the clues are still subtle, nonetheless with Hugo Chavez asking for Venezuela’sgold to be returned we must ask is this the tipping point in the physical gold market that is the start of a trend? Likely not as Chavez is more likely trying to remove assets that can potentially be confiscated in case he loses a lawsuit for kicking out the oil companies and various others he nationalized over the years. But it did make people stand up and think for a minute and this will lead up to the tipping point in gold as the next steps are currencies.

The recent Swiss move to deflate their currency, is this the start of currency wars and the race to the bottom? The next step will be protectionism as governments suffering from falling exports will attempt to protect local champions via protective taxes, tariffs and the limiting of certain imports. Affected governments and industries will retaliate for their own loss of exports and so on and so forth. Welcome to the currency wars.

The end result will be an eventual eroding of faith in the US government credit. The market will eventually wake up and realize that monetization is the one and only way our government can kick the can down the road without immediately collapsing the economy. Which means fixed income investors will lose ad infinitum. Imagine a pension fund or insurance company with a 5-8% real return hurdle rate. How can they possibly stay in 10yr Treasuries with a negative real yield? They can’t. The Bond vigilantes will eventually stir and move into other asset classes en masse. This shift out of public assets and in to private assets will represent a change in preferences that has lasted since 1980, over 31 years. The death of the long-term bull market in government debt will mean the nail in the coffin for the USD and the US role as sole superpower. It will also mean incredibly interesting things for the ultimate reserve currency, gold.

Bottom line: now is a great time to get out of government paper and many miles away from the large US and European banks. I am a broken record on this but you should own gold and silver miners, fertilizer companies, oil companies and water companies. Some technology stocks could make sense and reasonable exposure to Asia and Latin America. Corporate bonds of companies providing any of the products listed above (gold/silver, fertilizers, oil and water) makes a ton of sense. I would avoid the large multi-nationals here as I think trade wars are coming and their cash flows from foreign operations are about to come under fire.

By the way the US debt ceiling has been reached again in a month!

Got Gold ?

![[ROI_100524]](http://sg.wsj.net/public/resources/images/OB-IP413_ROI_10_NS_20100524192106.gif)