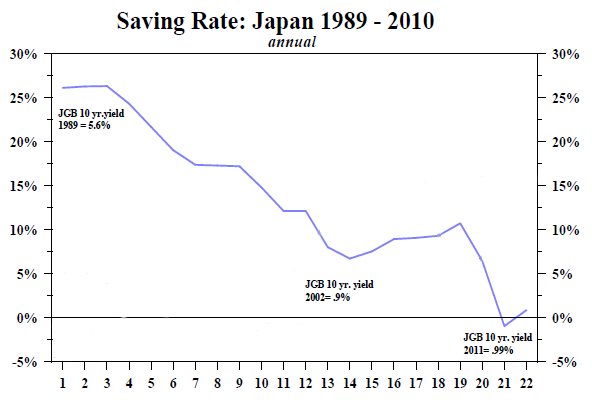

Stagnating tax revenue and rapidly-diminishing savings rates which, as the graph below shows, have plummeted from 25% in 1989 to just above 0% today. The rate dropped precipitously in 2008 and briefly went negative in 2009/2010 before inching higher again. problems; stagnating tax revenue and rapidly-diminishing savings rates which, as the graph below shows, have plummeted from 25% in 1989 to just above 0% today. The rate dropped precipitously in 2008 and briefly went negative in 2009/2010 before inching higher again.

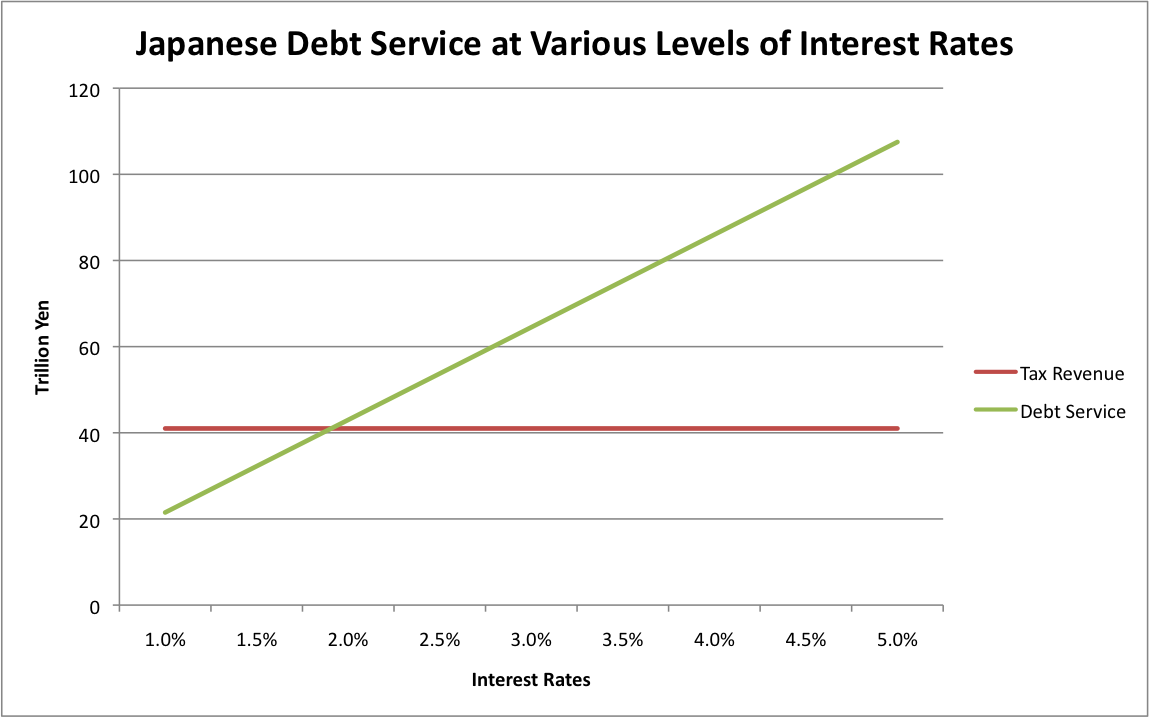

Should Japan need to fund itself externally, it is every Japan-watcher’s base-case that it will need to offer substantially higher rates in order to be able to do so and, with the mountain of debt under which Japan is currently foundering and the tiny amount of room it has before its tax revenues are eaten up by its debt-servicing costs. It currently spends over 50% of those tax revenues in such a fashion and it would only take an increase in borrowing costs to 2% for that figure to reach 100% (chart, below). At that point, you can finally stick a fork in Japan.

When the Green line passes through the red Japan is going to print.