There are very few government exceptions within Western Society that are without serious trouble with their pensions. While politicians conveniently focus on tax compliance and cross border information exchange, and create yet more bureaucracy to shore up tax revenue, they have done an incredible job of distracting from their mismanagement of tax payers’ funds at best, and committing massive fraud at worst. They need to focus on Spending and come to terms with the fact the problem is politicians and government spending. Not a revenue problem like they are trying to tell us. Public unions are simply demanding that governments raise taxes and extort money from other sectors to hand to them.

Government pension funds are a joke. Even in Britain, pensions will run out of cash next year: Amount handed out to future generations will be disastrous. Those under 35 should not expect anything for their taxes.

The 25 largest U.S. public pensions face about $2 trillion in unfunded liabilities, showing that investment returns can’t keep up with ballooning obligations, according to Moody’s Investors Service.

The Times noted that one major pension plan, the Teamsters’ Central States plan, pays out $2.8 billion per year in retirement funds, but only takes in about $700 million from corporations. The plan’s director said he expects the plan to run out of money in 10 to 15 years.

Last year, the Pension Benefit Guaranty Corporation posted a record deficit of $35.7 billion. “Within the next 10 years, more and more plans are going to run out of money,” said Joshua Gotbaum, director of the Pension Benefit Guaranty Corp, in a November report.

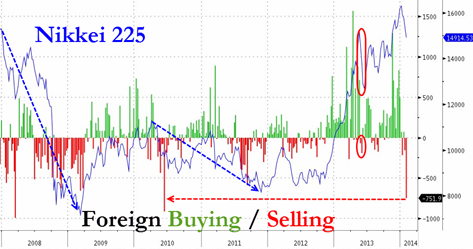

On average, the top-20 pension funds in the world invested on average 40.6 percent of their assets in fixed income securities and 42.7 percent in equities. The average return on Fixed income with the benchmark ten-year Treasury bond paying under 2.9%. The bull run that started in the 1980’s is over, bonds are the bubble and will become toxic.

In New York City, over the past 12 years our pension costs have gone from $1.5 billion to $8.2 billion. That’s almost a 500 percent increase — when inflation totaled only 35 percent. The $7 billion additional that taxpayers are forced to spend on pensions every year is $7 billion more that cannot be invested in our schools and our parks and our social safety net, or our mass transit system, or our climate resiliency work, or our affordable housing efforts, or our tax-relief for working families.

Think about it this way: During our administration’s time in office, we’ve spent $68 billion in taxpayer money on pensions, compared to $5.3 billion on affordable housing. So taxpayers spent about 13 dollars on pensions for every one dollar that they invest in affordable housing.

Pension consultant Girard Miller recently told California’s Little Hoover Commission that state and local government bodies in the state of California have $325 billion in combined unfunded pension liabilities. When you break that down, it comes to $22,000 for every single working adult in California.

Despite the UK’s looming pensions crisis, over a third of Britons says they will never save or invest for their retirement.

So how is your planning going? Do you have a private personal portable pension?

Talk to Banner and we can help you start or review and enhance what you have – get in touch today on the various options. info@bannerjapan.com 03 5724 5100