Gold Is Over – Just Like in 1976

An excellent post from Jeff Clark at Casey research on gold and history. We strongly agree and as stated earlier feel now is the time to accumulate gold as there will be a significant rise in prices going forward we see all-time highs broken in 2015 or earlier.

Gold Is Over – Just Like in 1976

By Jeff Clark, Senior Precious Metals Analyst

Goldman Sachs has lowered its gold price projections and says the metal is headed to $1,200. Credit Suisse and UBS are bearish. Citigroup says the gold bull market is over.

So I guess it’s time to pack it in, right?

Not so fast. As we’ve written before, these types of analysts have been consistently wrong about gold throughout this bull cycle. Another reason to disagree, however, is history; we’ve seen this movie before. In the middle of one of the greatest gold bull markets in modern history – the one that culminated in the 1980 peak – gold experienced a 20-month, one-way decline. Every time it seemed to stabilize, the bottom would fall out again. From December 30, 1974 to August 25, 1976, gold fell a whopping 47%.

1976 had to be a tough year for gold investors. The price had already been declining for a year – and it just kept on sinking. Since that’s similar to what we’re experiencing today, I wondered, What were the pundits were saying then? I wanted to find out.

I enlisted the help of two local librarians, along with my wife and son, to dig up some quotes from that year. It wasn’t easy, because publications weren’t in digital form yet, and electronic searches had limited success. But we did uncover some nuggets I thought you might find interesting.

The context for that year is that the IMF had three major gold auctions from June to September, dumping a lot of gold onto the market. Both the US and the Soviet Union were also selling gold at the time. It was no secret that the US was trying to remove gold from the monetary system; direct convertibility of the dollar to gold had ended on August 15, 1971.

The public statements below were all made in 1976. You’ll see that they aren’t all necessarily bearish, but I included a range to give a sense of what was happening at the time, especially regarding the mood of the gold market. I think you’ll agree that much of this sounds awfully darn familiar. I couldn’t resist making a few comments of my own, too.

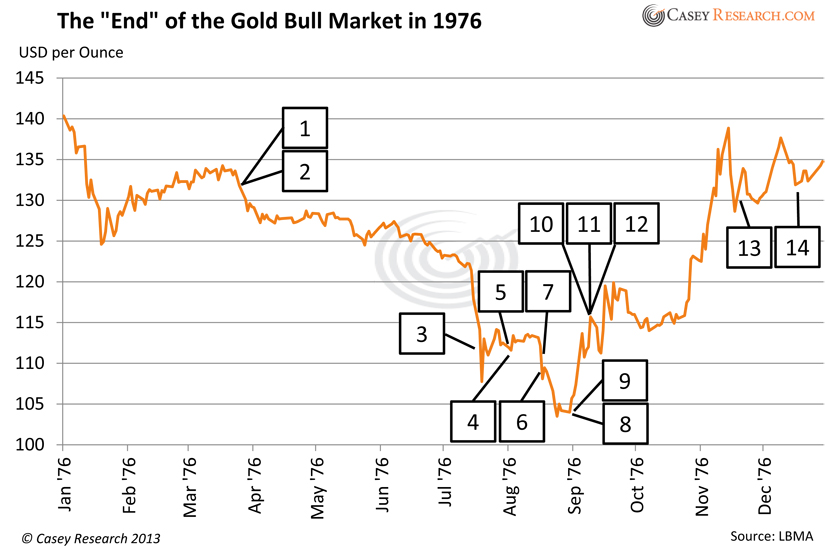

To highlight the timing, I put the comments into a price chart, pinpointing when they were said relative to the market. Keep in mind as you read them that the gold price bottomed on August 25, and then began a three-and-a-half year, 721% climb…

(Click on image to enlarge)

[1] “For the moment at least, the party seems to be over.” New York Times, March 26.

[2] “Though happily out of the precious metal, Mr. Heim is no more bullish on the present state of the stock market than any of the unreconstructed gold bugs he’s had so much fun twitting of late. He’s urging his clients to put their money into Treasury bills.” New York Times, March 26.

Me: These comments remind me of those today who poke fun at gold investors. I wonder if Mr. Heim was still “twitting” a couple years later?

[3] “‘It’s a seller’s market. No one is buying gold,’ a dealer in Zurich said.” New York Times, July 20.

Turns out this would’ve been an incredible buyer’s market – but only for those with the courage to buy more when gold dropped still lower before taking off again.

[4] “Though the price recovered to $111 by week’s end, that is still a dismal figure for gold bugs, who not long ago were forecasting prices of $300 or more.” Time magazine, August 2.

The “gold bugs” were eventually right; gold hit $300 almost exactly three years later, a 170% rise.

[5] “Meanwhile, the economic conditions that triggered the gold boom of 1973 through 1974, have largely disappeared. The dollar is steady, world inflation rates have come down, and the general panic set off by the oil crisis has abated. All those trends reduce the distrust of paper money that moves many speculators to put their funds in gold.” Time magazine, August 2.

This view ended up being shortsighted, as these conditions all reversed before the decade was over. Does this sound similar to pundits today claiming the reasons for buying gold have disappeared?

[6] “Our own predictions are that gold will go below $100, with some hesitation possible at the $100 level.” As stated by Mr. Heim in the August 19 New York Times.

Yes, this is the same gentleman as #2 above. I wonder how many of his clients were still with him a few years later?

[7] “Currently, Mr. LaLoggia has this to say: ‘There is simply nothing in the economic picture today to cause a rush into gold. The technical damage caused by the decline is enormous and it cannot be erased quickly. Avoid gold and gold stocks.'” New York Times, August 19.

You can see that these comments were made literally within days of the bottom! Take note, technical analysts.

[8] “‘Gold was an inflation hedge in the early 1970s,’ the Citibank letter says. ‘But money is now a gold-price hedge.'” New York Times, August 29.

Wow, were they kidding?! This reminds me of those dimwits journalists who said in 2011 to not invest in gold because it isn’t “backed by anything.”

[9] “Private American purchases of gold, once this was legalized at the end of 1974, never materialized on a large scale. If the gold bugs have indeed been routed, special responsibilities fall on the victorious dollar.” New York Times, August 29.

The USD’s purchasing power has declined by 80% since this article declared the dollar “victorious.”

[10] “Some experts, with good records in gold trading, declare it is still too early to buy bullion.”New York Times, September 12.

Too bad; they could’ve cleaned up.

[11] “Wall Street’s biggest brokerage houses, after having scorned gold investments during the bargain days of the late 1960s and early 1970s, made a great display of arriving late at the party.” New York Times, September 12.

No comment necessary.

[12] “He believes the price of bullion is headed below $100 an ounce. ‘Who wants to put money over there now?'” As stated by Lawrence Helm in the New York Times, September 12.

The price of gold had bottomed two weeks before, making the timing of this advice about the worst it could possibly be.

[13] Author Elliot Janeway, whose book jacket states, “Presidents listen to him,” was asked by a book reviewer about his preferred investments. He writes: “Then, gold and silver? He likes neither. In fact he writes: ‘Any argument against putting your trust in gold, and backing it up with money, goes double for silver: silver is fool’s gold.'” New York Times, November 21.

Mr. Janeway ate his words big-time: from the date of his comments to silver’s peak of $50 on January 21, 1980, silver rose 1,055%!

[14] “Mr. Holt admits that ‘in 1974, intense speculation caused the gold price to get too far ahead of itself.'” New York Times, December 19.

So, anything sound familiar here? Yes, it was a brutal time for gold investors, but what’s obvious is that those who looked only at the price and ignored the fundamentals ended up eating their words and dispensing horrible advice. Investors who followed the “wisdom of the day” missed out on one of the greatest opportunities for profit in their lifetimes.

I was pleased to learn, though, that not all comments were negative in 1976. In fact, in the middle of the “great selloff,” there were those who remained stanchly bullish. These investors must’ve been viewed as outliers – they, much like some of us now, were the contrarians of the day.

Also from 1976…

- “Many gold issues, in fact, are down 40 percent or more from their highs. Investors who overstayed the market are apparently making their disenchantment known. The current issue of the Lowe Investment and Financial Letter says, ‘We are showing losses on our gold mining share recommended list… but keep in mind that these shares are for the long-term as investments.'” New York Times, March 26.Sounds like what you might read in an issue of BIG GOLD or the International Speculator.

- “The time to buy gold shares,” [James Dines] declares, “is when there is blood in the streets.”New York Times, September 12.If you glance at the chart above, Jim’s comments were made within two weeks of the absolute low.

- “We’re recommending to clients that they hold gold and gold shares,” [C. Austin Barker, consulting economist] says. “The low-production-cost mines in South Africa might be interesting to buy for the longer term because I see further inflation ahead.” New York Times, September 12.Investors who listened to Mr. Barker ended up seeing massive gains in their gold and gold equity holdings.

- “The probability of runaway inflation by 1980 is 50%… In light of this, the only safe investments are gold, silver, and Swiss francs,'” said the late Harry Browne on November 21 in the New York Times.Browne’s Special Reports were edited by our own Terry Coxon for 23 years, along with all his books since 1974.

- “In the longer run, [Jeffrey Nichols of Argus Research] believes gold’s price trend ‘is much more likely to be upward than downward.'” New York Times, December 19.The “longer run” won.

- “‘I think the intermediate outlook for gold is a period of consolidation and a bit of dullness,’ says Mr. Werden. ‘However, six or nine months from now, we could see renewed interest in gold.'”New York Times, December 19.He was right; within nine months gold had risen 13.5%.

- “Mr. Holt offers some advice to investors who are taking tax losses on their South African gold shares – some of which are selling at just 30 to 35 percent of their peak prices in 1974. ‘If leverage has worked against you on the way down,’ he reasons, ‘why not take advantage of it on the way up?'” New York Times, December 19.Solid advice for investors today, too.

- “What’s his [Thomas J. Holt] prediction for the future price of gold? ‘A new high, reaching above $200 an ounce, within the next couple years.'” New York Times, December 19.His prediction was conservative; gold reached $200 nineteen months later, by July 1978.

It’s clear that there were positive “voices in the wilderness” during that big correction, and as we all know, those who listened profited mightily.

There were other interesting tidbits, too. For example, gold stocks had been performing so poorly for so long that some advisors suggested a strategy we also hear today…

- “It is probably too late to sell gold shares, the stock market’s worst-acting group these days, except for one possible strategy: selling to take a tax loss and switching into a comparable gold security to retain a position in the group.” New York Times, September 12.

Even back then, it was widely known that gold often bucks the trend of the broader markets…

- “You might put a small portion of your money into gold shares and pray like the dickens that you lose half of it. In that way, chances are that if gold shares go down, the rest of your stock portfolio will go up.” New York Times, September 12.

Gold miners provided critical revenue and jobs, just like today. From the August 2 issue of Timemagazine…

- “South Africa, the world’s largest gold producer, is being hurt the most. The price drop will cost it at least $200 million in potential export earnings this year.”

- “Layoffs at the gold mines would make it even worse – the joblessness could intensify South Africa’s explosive racial unrest.”

- The Soviet Union, the world’s second-largest gold producer, is feeling the price drop, too. The Soviets depend on gold sales to get hard currency needed to buy US grain and other imports.”

Gold was also used as collateral…

- “The international gold market was also roiled yesterday by a report by the Commodity News Service that Iran was negotiating to lend South Africa roughly $600 million, predicated on a collateral of 6.25 million ounces of gold.”

And just like today, there were plenty of stupid misguided US politicians: From the New York Timeson August 27:

- “The drop in gold bullion prices from $126, which was the average at the first IMF auction June 2, provoked the Swiss National Bank to attack Washington’s attitude toward the metal as ‘childish.’ Aside from the estimated $4.8 billion of gold reserves held by Switzerland, bankers there advocate some role for the metal as a form of discipline against unrestricted printing of paper money.”

That last statement from the Swiss bankers is hauntingly just as true today.

Last, you know how the government in India has been tinkering with the precious-metals market in its country? And how it’s led to smuggling? From the New York Times on August 27:

- “India announced it was resuming its ban on the export of silver. India is believed to have the largest silver hoard and the government there freed exports earlier this year as a means of earning taxes levied on overseas sales. However, most silver dealers minimized the significance of India’s move yesterday. As one dealer explained, ‘Smuggling silver out of India is so ingrained there that the ban will have no effect on the flow. It never has. Indian silver will continue to ebb and flow into the world market according to price.'”

So what’s the difference in mood today vs. the mid-1970s? Nothing! This shows that the same concerns, fears, and confusion we have now existed at a similar point in the gold market then. There were also those who saw the big picture and stayed vigilant. Virtually every comment made in 1976 could apply to today. Keep in mind that most of the statements above are from two publications only; there are undoubtedly many more similar comments from that year.

The obvious lesson here is that patience won out in the end. It took the gold price three years and seven months to return to its December 1974 high. It only took another 18 months to soar to $850. Today, that would be the equivalent of gold falling until June this year, and not returning to its $1,921 high until April, 2015. It would also mean we climb to $6,227 and get there in November, 2016. Could you wait that long for a fourfold return?

This review of history gives us the confidence to know that our gold investments are on the right track. I hope you’ll join me and everyone else at Casey Research in accepting this message from history and staying the course.

So, what will your kids or grandkids read in a few decades?

- “Buy gold. It’s going a lot higher.” Jeff Clark, Casey Research, March 4, 2013.

Finance in Focus Feb 2013; Sign Posts

http://www.facebook.com/pages/Banner-Financial-Services-Japan/100998180008073?ref=hl

Investing is not easy one has to be constantly looking for sign posts and directions from the ever moving, ever changing massive organism called the markets. There is never one thing that is the “oh that’s it” but even where there seems to be it is often opaque and always debatable. There is never a perfect solution and we don’t have the advantage of hindsight – ever- in investing.

So what are the latest sign posts we should be paying attention to?

Here in Japan current sign post is definitely “Abenomics” and the wish for 2% inflation. It is often said “be careful what you wish for”, as with 2% inflation one will get increased interest rates. If interest rates were to increase from the low levels here in Japan to say 2% this would mean japan would be spending more than 70% of the ENTIRE TAX revenue currently to just pay the interest on the continually rising debt! So we watch and wait for the next sign post which will be the upper house elections, should Abe and the LDP win, then the “Let’s Destroy Party” may actually get its wish, the problem being they do not know what they are going to get. Likely a much, much weaker Yen and a structurally changed economy. Why? you may ask. China and Japan are posturing for political gains – However China used to buy 20% plus of Japan’s exports now this is clearly declining and being replaced by purchases elsewhere – this is a structural change that will very likely not change back. Just another problem to add to Japan’s ever growing list of economic woes.

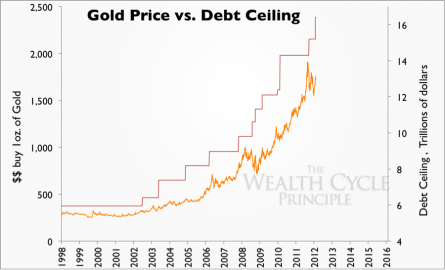

The next sign post is the US debt ceiling – however, one we think will be just simply raised with no meaningful debt reduction. We wait to see what happens but unless the Republicans do something this will just be kicked down the road. The S&P has broken 1,500 again third time now the others were in 2000 and 2007 . . . will this be a third time lucky or are we getting very toppy on declining volumes? Declining volumes are never the sign of a healthy rally and they have been declining for four years.

The European sign posts are many, however the big one is the September German elections. Will Merkel win? If she does not who will the new government be and will they have an Anti-EU stance? I.E. no monetary union . . .

The Gold comment we made in July last year still holds — GOLD — 2012~2017

Gold is not going to go up because of all the conspiracy claims nor because the real gold will conquer the paper gold. This is all about reality. Gold is a viable part of the portfolio. It will rise to the occasion when the timing is right. The very people accused of keeping it down are the very people who will turn around and send it up as well. This is just about time. Nothing more! When the time is right and people realize that the Governments have no Clothes, look out there will be a stampede at that time. For now, that still appears headed into 2015~2017.

Gold is neutral and the next turning point will be a big one. Monthly closing resistance remains at 1755 and the primary resistance for the next 6 months is still 1807. The primary support lies at 1570 and 1480. Thus, as long as gold remains within 1807 to 1480 (Sign Posts), it is effectively neutral, so slowly and patiently accumulate!

Gold is a good investment NOT because of all the fiat nonsense, but because inflation has passed it by and there will be a huge burst of price movement. That will come when the Sovereign Debt Crisis hits the USA and that does not seem likely until the autumn of 2015.

One theory as to why gold prices aren’t bounding above $2000 is simply this: the central banks have so far failed to produce any meaningful inflation. The untold trillions worth of stimulus they have shot at this goal have barely kept deflation at bay. Granted, prices for groceries, health care and some other necessities have gone up (outside Japan). But the inflationary impact of all of these things together is inconsequential in comparison to the deflationary down force of a quadrillion dollar financial edifice that remains in a state of incipient collapse.

Please feel free to get in touch and discuss any topic on savings and investing and how to get your YEN working.

Finance in Focus Dec. 2012 Thoughts

There are many predictions for the price of silver and gold. Some say silver will crash to nearly $20 and gold back under $1,200, and others proclaim silver $100 and gold at $2,500 by the end of 2012. The problem is that some predictions are only wishful thinking, others are obvious disinformation designed to scare investors away from silver and gold, and many are not grounded in hard data and clear analysis. Other analysis is excellent, but both the process and analysis are difficult to understand. Is there an objective and rational method to project a future silver price that will make sense to most people? Clearly Yes!

I am not predicting a future price of silver or the date that silver will trade at $100, but I am making a projection based on rational analysis that indicates a likely time period for silver to trade at $100 per ounce. Yes, $100 silver is completely plausible if you assume the following:

- The US government will continue to spend in excess of $1 Trillion per year more than it collects in revenue, as it has done for the previous four years, and as the government budget projects for many more years.

- Our financial world continues on its current path of deficit spending, debt monetization, Quantitative Easing (QE), weaker currencies, war and welfare, ballooning debts, and business as usual.

- A massive and devastating financial and economic melt-down does NOT occur in the next four to six years. If such a melt-down occurs, the price of silver could skyrocket during hyperinflation or stagnate under a deflationary depression scenario. (best candidate for hyperinflation = JAPAN)

Same is true for $2,500+ gold prices.

USA National debt projections: by 2020 it will be over 20+ TRILLION

http://en.wikipedia.org/wiki/File:CBO_-_Public_Debt_Scenarios_-_June_2011.png

Also, With a debt to GDP ratio now at 105%, the U.S. crossed the significant 100% threshold around the beginning of the year. The deeper into debt the U.S. and other countries around the world go, the less valuable the dollar and all paper currencies become—and the higher the value for gold.

We may be skeptical of price projections for silver and gold, but projections for national debt are quite believable. Since the correlation is very close, future silver prices can be projected, assuming continuing deficit spending, QE, and other macroeconomic influences. A dollar crash or an unexpected bout of congressional fiscal responsibility could accelerate or delay the date silver trades at $100, but the projection is reasonable and sensible. Silver increased from $4.01 (November 2001) to over $48 (April 2011). A silver price of $48 seemed nearly impossible in 2001, yet it happened. An increase from about $32 (October 2012) to $100 (perhaps in 2015 – 2016) especially after Bernanke’s recent announcement of QE4-Ever.

All this makes $100+ silver and $3,500+ gold seem very possible.

Finance in Focus Sept 2012

Congratulations to everyone who got some gold and gold shares in the last several months!

As we said in the Summer Finance in Focus and numerous times this year to invest in gold – QE#3 was coming and gold investors will be rewarded.

We will be updating in our next Finance in Focus the likely direction of gold in the next few months.

Recent trades we can highlight;

Silver Wheaton buy; on average $25 – we are now trading at just over $37.

GDXJ – junior gold miners average buy; Average $20 – we are now trading at $24

BMG Bullion funds – average buy $12 now trading at $13.45

There is one more thing that Bernanke could do, to become a gold bug’s best friend, it would be to announce QE to infinity. Today’s 40 billion per month is the Fed’s final shot and it means the terminal start of currency debasement is now here.

It also means that the path to all time nominal highs in gold, which is now just $160 away, silver, platinum, and all other metals, as well as all other hard assets is now clear. The first target is the inflation adjusted high of $2,300.

Nothing goes in a straight line and we expect the sector to slow in the next couple of weeks. This is not the end of the rally! Just the beginning. And the next several weeks will give everyone a new buying opportunity to add or create new positions.

Bernanke’s remarks included the boast that Fed policy had created stable inflation over the past decade. That would mean CPI inflation, which calculation has been suspect since the Clinton revision. But financial asset inflation and volatility has become dangerous. This cannot work out well, despite the belief that massive stimulus will revive the failing global economy. The 24 percent plunge the price of China’s iron ore price is a voice of opposition to Fed and ECB wishful thinking.

We can’t help but wonder about Romney’s statement that as president he would retire Bernanke from the Fed. Perhaps the MBS buying program is an attempt to help Obama, which would likely insure that Bernanke’s career as the master inflator continues.

Going forward QE is only part of the answer. In the next several months we have the fiscal cliff, Europe & China’s economies and the mix of all these outcomes will be very important.

Finance in Focus Summer 2012

GOLD — 2012~2017

Gold is not going to go up because of all the conspiracy claims nor because the real gold will conquer the paper gold. This is all about reality. Gold is a viable part of the portfolio. It will rise to the occasion when the timing is right. The very people accused of keeping it down are the very people who will turn around and send it up as well. This is just about time. Nothing more! When the time is right and people realize that the Governments have no Clothes, look out – there will be a stampede at that time. For now, that still appears headed into 2015~2017.

Gold is neutral and the next turning point will be a big one September. Monthly closing resistance remains at 1755 and the primary resistance for the next 6 months is still 1807. The primary support lies at 1570 and 1480. Thus, as long as gold remains within 1807 to 1480, it is effectively neutral, so slowly and patiently accumulate!

Under a gold standard, the yellow metal DECLINES with inflation and rises with DEFLATION precisely opposite when it is a free floating market. So let’s get this straight. Gold rallied after 1934 because (1) Roosevelt confiscated gold, and (2) devalued the dollar raising gold from $20.67 to $35.

Gold is a good investment NOT because of all the fiat nonsense, but because inflation has passed it by and there will be a huge burst of price movement. That will come when the Sovereign Debt Crisis hits the USA and that does not seem likely until the autumn of 2015.

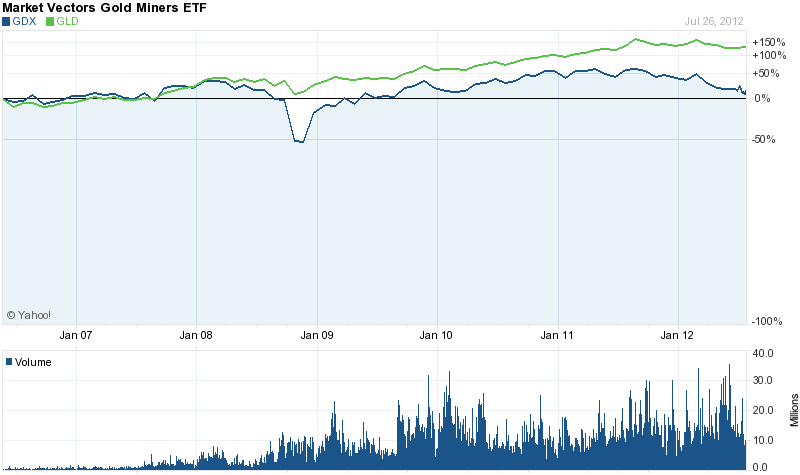

If you take a look at a 5 year chart of the gold stock ETF (GDX) vs. the gold bullion ETF (GLD), gold mining stocks are up about 25% from where they were 5 years ago, while the price of gold is up about 145%! Gold has risen about 5.8X more than gold stocks, when it should be the other way around considering how rapidly the profitability of gold miners is surging!

We believe gold has the potential to rise 24% to $2,000 per ounce in 2013, but I also believe gold stocks will outperform gold bullion for the rest of 2012! The average gold stock has the potential to double before year-end, with some small-cap gold stocks making huge gains. What would cause this to happen? The Fed – If they start a new QE program or even if they specify a new program with the specific term “FLOW” of purchases to keep rates low and buy say $50 to $75 billion per month of bonds this will be the catalyst to send gold beyond 1807 on its way too $2,000 and beyond. We have a couple of great options on how to invest in gold give us a call to find out more. 03 5724 5100

Shorter Term GOLD

Gold and silver have taken more of a back seat over the past 12 months because of their lack of performance after topping out in 2011. Since then prices have been trading sideways/lower with declining volume.

Bullish Case: Euro-land starts to crumble, stocks fall sharply sending money into gold and silver which are trading at these major support levels which in the past triggered multi month rallies.

Bearish Case: Greece, Spain and Italy work through their issues over the next few months while metals bounce around or drift higher because of uncertainty. But once things have been sorted out and financial stability (of some sort) has been created and the END OF THE FINANCIAL COLLAPSE has been avoided money will no longer want to be in precious metals but rather move into risk-on.

Over the next few months things will slowly start to unfold and shed some light on what the next big move is likely going to happen to gold and silver. The price movements we have seen for both gold and silver indicate were are just warming up for something really big to happen.

The Pew Center has released its annual summary of US pension and retirement health care (under)funding. As of 2010, the total underfunding gap rose by $120 billion from the prior year’s $1.26 trillion deficit to a record $1.38 trillion underfunding. This number consists of $757 billion in pension promises, not backed by any hard cash, representing pension liabilities of $3.07 trillion and assets of $2.31 trillion. In 2000, more than half of the states had their pensions 100 percent funded, but by 2010 only Wisconsin was fully funded, and 34 were below the 80 percent threshold—up from 31 in 2009 and just 22 in 2008. But that pales in comparison to the ridiculous spread between retiree health care liabilities of $660 billion and assets of, drum roll, $33 billion, or a funding shortage that is $627 billion, roughly 19 times the actual assets in the system! Just seven states funded 25 percent or more of their retiree health care obligations: Alaska, Arizona, North Dakota, Ohio, Oregon, Virginia, and Wisconsin. What this means is soon US pensioners will have no choice but to experience not only austerity unlike any seen in Europe, but broken promises of retirement benefits which will never materialize. The response will likewise be proportional.

Sadly, it is only going to get worse. So what should you do? Take out a personal savings plan . .. general details here

Finance in Focus June 2012

We very much agree with Bruce Krasting; The big lie today is about Greece. Almost every story I read on this topic is the same. If Greece is forced to leave the Euro very very bad things will happen, including:

1) Serious hardship will befall the Greek economy. Unemployment will rise, the economy will fall.

2) Contagion will spread from Greece. Countries such as Spain and Italy will come under attack. Their ability to float new bonds will be impaired. The cost of debt will hinder their ability to grow; unemployment will rise.

3) If Greece goes into the toilet, there will be capital outflows from Southern Europe to Germany. These capital flows will undermine the banks and capital markets of countries in the EU.

4) If the Euro Zone is unstable, then the global stock markets will fall. As equity markets tank, the global economy will go back into recession (or worse). Therefore there is no option but to save Greece.

This is complete horse sh!t.

1) Greece has been in a recession for five years. There is not one chance in a hundred that it is going to get out of recession anytime in the next five years if it stays in the Euro. The kindest thing that the leaders in Europe could do would be to kick Greece out. Greece should never have been in the Euro in the first place. Mistakes were made. Mistakes are always expensive, but the worst mistake is not recognizing that a mistake was made.

2) Contagion? What is going on today if not contagion? Every country in Europe is already infected. The disease has now spread around the globe.

3) Capital flight will happen if Greece goes turtle? Over the past two months reported capital outflows from the PIIGS exceeds $200 billion. (I think it is much higher than that.) German and Swiss bond yields have gone negative the past few weeks. There are border guards surrounding Switzerland these days to keep hot money out.

4) The US stock market has lost a cool $1 trillion since the May 6 Greek election ($357 billion on Friday alone). Global stock markets have fallen another $1T in the same period. The book losses on other asset classes is enormous. If you add up the losses in the past three weeks, it easily exceeds $3T (5% of total world GDP).

The best thing the politicians could do for the voters they represent is to just let Greece go. Yes there would be costs, but the costs of pretending that there is a viable option to keep Greece in the Euro will be ten times the cost. If all of Greece’s debt were wiped out, the cost would be $250 billion. By my calculation, the world has already paid a price 12 times higher than that in just the past three weeks. If the game with Greece continues, the cost will be $10 trillion and a global depression. The pundits and pols are saying that the worst case is a Grexit. I say the worst case is another effort to keep Greece in.

The blow up in Europe (and damn near every corner of the globe) the past month has led most observers to conclude that another round of Federal Reserve intervention is a just few weeks away. The pundits believe that Ben Bernanke will rise up and push some monetary buttons and all will be well again.

How can supposedly bright people believe that another four month – Fed induced sugar high can do any good at this point? This is as stupid as the forecast that stocks were going to keep rising a few months ago. The Fed is powerless to change things; the markets have already done more than the Fed could ever do.

What might the Fed do next according to the seers? Promise to keep rates low for a long period of time? Ridiculous. We have been living with ZIRP for four years. It hasn’t worked. It’s not going to work.

The Fed could extend Operation Twist, but that would not do anything either. The ten-year is at 1.45%. Who in their right mind would think that pushing the T-bond to 1.2% would make a difference? Only a fool.

Some are pushing for another round of pure QE. The Fed would buy up another $600 billion of Treasury bonds and mortgage paper. It would print the money to pay for the purchases. That thinking is insane. If the Fed were to announce a big QE program, the markets might rally for a week, but when reality sinks in, and the downside of further monetary expansion is realized, the markets would resume their slide.

Don’t believe in the pundits out there that make it on TV every day. They are either shills for their employers, blind and stupid or just flat out lying. Don’t believe in the politicians or central bankers who are pushing the case for more monetary gas. Those folks are so pregnant with their past mistakes, they can’t possibly change direction. Rather than admit their mistakes, they will double up and make the same bad choices again.

There is only one option left for policy makers. Get real. Greece has to go, Spain too. Printing money will not work, that has to stop. Yes, that direction is painful. It will cost the Germans a bundle to make things right, but that is cost it must bear. After all, Germany did create this mess, and Germany benefited from it for a dozen years. The rest of the world will suffer as well. But what is the alternative?

The ship is sinking. The captains are embarrassed that they have put the ship on a reef. They don’t want to admit to past sins so they refuse to put the lifeboats in the water for fear that the passengers will lose confidence. What those captains are actually doing is insuring that all the folks on board will drown. I would like to see a few of those captains go down with the ship, but it is unnecessary that all the passengers (seven billion) drown too.

We are on the edge of a very hard landing. I don’t think it can be avoided any longer. The next two weeks are critical. Either the globe goes through yet another round of “extend and pretend” that won’t work, or we let some boats sink. A year after those boats and their captains sink, the world will be a much better place. If the decision is made to keep the sinking ships afloat, we will pay for it with another decade of deflation.

So have you bought your gold and gold/ Silver miner shares yet?

Get in touch we can help. 03 5724 5100 info@bannerjapan.com

Look at the last Chart . . .

By now everyone has seen some iteration the following chart of relative sovereign debt/GDP values, in which Japan is an outlier:

As well as this chart of sovereign interest to revenue, in which Japan is also an outlier:

And certainly this chart showing Japan’s straight diagonal line of debt/GDP:

But how many have seen this chart showing global sovereign debt as a percentage of total government revenues?

Is there now any doubt after seeing this why the proverbial four horseman are really just one giant black swan, only not one of failed bond auctions or something quite as dramatic, but something as simple and mundane as the smallest uptick higher in rates which would blow up the entire global financial farce, starting with the most imbalanced domino of all – the land of the rising sun?… And that at least Greece is not Japan?

Source: Harvard Business School, 9-212-091, Hayman Capital Management,

Japanese Bond Bubble Is Ready To Burst, Anticipates 40% Yen Devaluation

It is a fact that when it comes to the oddly resilient Japanese hyperlevered economic model, the bodies of those screaming for the end of the JGB bubble litter the sides of central planning’s tungsten brick road. Yet in the aftermath of last month’s stunning surge in the country’s trade deficit, this, and much more may soon be finally ending. Because as Caixin’s Andy Xie writes “The day of reckoning for the yen is not distant. Japanese companies are struggling with profitability. It only gets worse from here. When a major company goes bankrupt, this may change the prevailing psychology. A weak yen consensus will emerge then.” As for the bubble pop, it will be a sudden pop, not the 30 year deflationary whimper Mrs. Watanabe has gotten so used to: “Yen devaluation is likely to unfold quickly. A financial bubble doesn’t burst slowly. When it occurs, it just pops. The odds are that yen devaluation will occur over days. Only a large and sudden devaluation can keep the JGB yield low. Otherwise, the devaluation expectation will trigger a sharp rise in the JGB yield. The resulting worries over the government’s solvency could lead to a collapse of the JGB market.” It gets worse: “Of course, the government will collapse with the JGB market.” And once Japan falls, the rest of the world follows, says Xie, which is why he is now actively encouraging China, and all other Japanese trade partners of the world’s rapidly declining 3rd largest economy to take precautions for when this day comes… soon. Oh, and this: ” If the bond yield rises to 2 percent, the interest expense would surpass the total expected tax revenue of 42.3 trillion yen.”

Why has Japan been able to sustain its deflationary collapse for over 3 decades? Simply – an ever rising currency.

UK Budget 2012

| The main individual tax measures announced in today’s UK Budget are summarised below:

1. The tax-free personal allowance in 2012/13 is £8,105, increasing in 2013/14 to £9,205. 2. The higher rate 40% tax threshold is £42,475 in 2012/13, reducing in 2013/14 to £41,450. 3. The additional 50% tax rate for earnings above £150,000 remains at 50% for 2012/13 but reduces to 45% in 2013/14. 4. The main rate of income tax remains at 20%. 5. Legislation will be introduced to cap pension income tax reliefs from 6 April 2013. The cap will apply only to reliefs which are currently unlimited. For anyone seeking to claim more than £50,000 in reliefs, a cap will be set at 25 per cent of income (or £50,000, whichever is greater). Draft legislation will be published for consultation later this year. 6. New measures are introduced effective 22/3/12 to clamp down on stamp duty land tax (SDLT) avoidance through the use of companies to purchase UK proprty. A new 7% rate of duty is also introduced for properties of £2m and above. 7. A statutory residence test will be legislated in Finance Bill 2013 and take effect from 6 April 2013, to allow further time to finalise the detail of the test. 8. Time Apportionment: the Government will consult on reforming the time apportionment rules in the chargeable event gain regime that reflect a policyholder’s period of residence outside the UK. This will potentially impact on life insurance bonds, capital redemption bonds and life annuities. Any legislation will be in the Finance Bill 2013. 9. Life insurance: Qualifying Policies – limits will be introduced to the premiums that can be paid into qualifying life insurance policies with effect from 6 April 2013. Policies issued on or after this date will only be Qualifying Policies where the premiums payable for an individual into a policy or policies do not exceed £3,600 each year. Transitional provisions will also apply to qualifying policies issued on or after 21 March 2012 and before 6 April 2013, and before 21 March 2012 where certain variations are made after this date. This measure will be the subject of formal consultation with legislation to be introduced in Finance Bill 2013. 10. General anti-abuse rule (GAAR) – a GAAR targeted at artificial and abusive tax avoidance schemes will be introduced . The Government will consult on new draft legislation and the development of full explanatory guidance in summer 2012 with a view to introducing legislation in Finance Bill 2013 |